Written by: Max.S & Linda Zheng

In the perception spectrum of most investors, the NASDAQ is often simply defined as a stock exchange, a habitat for tech giants like NVIDIA, Tesla, and Apple. However, at a quantitative investment summit held in January, Ms. Anny Liu, MD of NASDAQ's data business for China and Singapore, redefined the identity of this giant with a set of data and strategic layout: it is not just a place for matching buy and sell orders, but also a fintech company serving over 100 exchanges globally, providing anti-financial crime systems and front-to-back management technology.

In 2025, the U.S. stock market is on the eve of dramatic transformation. From explosive growth in liquidity to the upcoming "23-hour trading" that will break time zone limitations, to the shocking proposal for "stock tokenization" submitted to the SEC, and the liquidity revolution in the private equity market. For quantitative funds and professional investors in the Asia-Pacific region, a paradigm shift regarding infrastructure, trading strategies, and asset forms is underway.

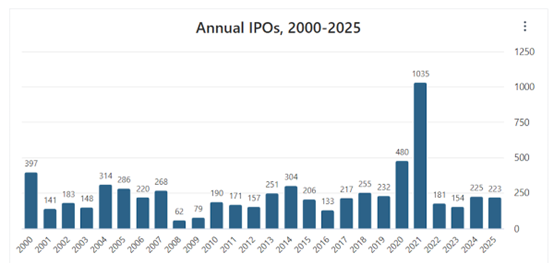

Data shows that in 2025, there will be a total of 336 IPOs in the U.S., with 281 occurring on NASDAQ, raising a total of $70 billion. When viewed in the context of the past two decades, only five years had more than 300 IPOs, and 2025 not only ranks among them but also shows a steady upward trend gradually emerging post-pandemic.

This prosperity in the primary market directly translates into the microstructure of the secondary market, with the most notable feature being the extreme stratification and retailization of liquidity.

In her speech, Anny Liu shared a set of striking comparative data: as a partner of NASDAQ, a top domestic cloud provider has compiled statistics on peak trading volumes across major markets. The peak trading volume in the A-share market is about 18,000 transactions per second, in the Hong Kong stock market about 65,000 transactions per second, while NASDAQ's peak data reached an astonishing 200,000 transactions per second.

It is important to note that this 200,000 transactions per second only represents NASDAQ's own matching capability. In the fragmented market structure of U.S. stocks, NASDAQ accounts for about 50%-60% of the total trading volume in the U.S. If we include the options market, its peak even reaches an astronomical figure of 20 million transactions per second.

Behind this surplus of liquidity is the extreme concentration of trading targets and the fervor of retail investor sentiment. On the list of active stocks at the end of 2025, in addition to the perennial "Big Seven" of U.S. stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla), we also see a large number of crypto asset-related ETFs (such as BTC, ETH ETFs) and silver ETFs. This indicates that the investor structure in the U.S. stock market is undergoing profound changes, with individual investors' demand for allocation to high-volatility, alternative assets reshaping the distribution of market liquidity.

For quantitative institutions, this means that the volume of data that traditional Order Book analysis models need to handle is increasing exponentially, and the competition for millisecond-level latency has entered a heated stage.

If the growth of liquidity is a linear quantitative change, then the extension of trading time is a structural qualitative change.

For a long time, the standard trading hours for U.S. stocks have been from 9:30 AM to 4:00 PM Eastern Time, plus pre-market and post-market trading, totaling about 16 hours. However, NASDAQ has officially announced plans to extend trading hours to 23 hours.

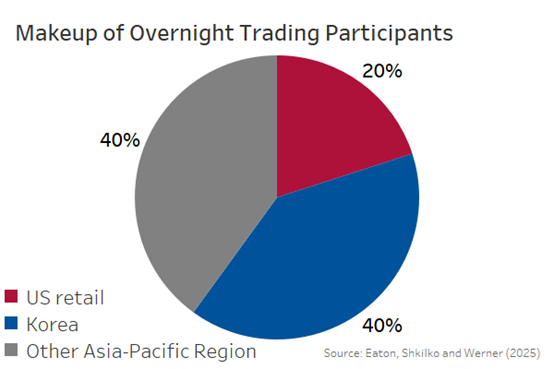

This decision is not a spur-of-the-moment idea but is based on precise capture of capital flows. NASDAQ's data shows that in the current night trading, 80% of the trading volume comes from regions outside the U.S. Among them, Asian investors, represented by South Korea, contribute astonishing liquidity — during certain specific periods, South Korean investors' trading volume even accounts for half of the entire night trading.

This transformation presents both a tremendous opportunity and a severe infrastructure challenge for quantitative institutions (Quants) in the Asia-Pacific region:

Infrastructure Arms Race: The "downtime" originally used for system maintenance, data cleaning, and model training is almost gone. To cope with 23 hours of continuous trading, hardware facilities, network bandwidth, and disaster recovery systems must undergo comprehensive upgrades to support high-frequency throughput around the clock.

Restructuring of Human Resources: The traditional "work at sunrise, rest at sunset" trading schedule will be completely ineffective. Institutions need to establish 24-hour trading desks covering global time zones, which not only requires an increase in manpower but also a reconfiguration of risk control processes — when New York is asleep, the severe fluctuations in Seoul and Singapore need to be captured and responded to in real-time.

Golden Window for Cross-Market Arbitrage: As U.S. stock trading hours cover Asian time zones, arbitrage opportunities between A-shares, Hong Kong stocks, and U.S. stocks linked (such as Chinese concept stocks and cross-market ETFs) will increase exponentially. Quantitative strategies that can achieve low-latency routing across multiple markets will gain significant Alpha returns.

In the Web3 space, RWA (Real World Assets) has always been a hot topic but is often limited by compliance and infrastructure. Now, the world's largest traditional financial giant, NASDAQ, is actively opening this door.

Traditional Model vs. Tokenization Model

Anny Liu revealed that NASDAQ has submitted a filing to the SEC, planning to launch stock tokenization trading. The revolutionary aspect of this move is that it is not simply issuing a new token, but changing the backend settlement mechanism while keeping the existing code (Ticker), order book (Order Book), and matching engine completely unchanged.

Traditional Model: Currently, while U.S. stocks have been shortened to T+1 settlement, they still fundamentally rely on the centralized ledger of DTCC (Depository Trust & Clearing Corporation), involving complex clearing and settlement processes, with capital occupation costs still present.

Tokenization Model: Through blockchain technology, stock trading can achieve atomic settlement. The moment an investor buys a stock, it means an immediate transfer of ownership, effectively T+0.

For investors, purchasing "tokenized stocks" is completely consistent with traditional stocks in terms of rights — whether it is dividend rights or voting rights, there is no difference. But in terms of trading experience, it will have the immediacy and programmability akin to cryptocurrencies.

On one hand, traditional giants like NASDAQ are pushing for compliant tokenized settlement from the top down; on the other hand, native Web3 forces are also accelerating the landing of RWA. We note that decentralized RWA platforms like MSX have begun to attempt direct support for purchasing RWA spot and derivatives with USDT/USDC/USD1. Unlike NASDAQ's underlying transformation, these native platforms focus more on utilizing existing DeFi infrastructure to directly bridge the liquidity channel between stablecoins and real assets.

When NASDAQ's tokenization proposal is officially implemented, combined with explorations from on-chain platforms like MSX, the future financial market will no longer have a clear distinction between the "fiat currency world" and the "crypto world." The liquidity friction between USDC and TSLA, NVDA will be significantly reduced, which may signify a golden era for arbitrage strategies for Crypto Quants.

Looking at 2025, the U.S. stock market is no longer the single market we are familiar with. It is transforming into a vast financial ecosystem that operates 23 hours a day, integrates blockchain settlement technology, and blurs the boundaries between public and private markets.

As Anny Liu stated, these are not merely adjustments to exchange rules but a reconstruction of underlying logic. In the current acceleration of the integration of Web3 and TradFi, NASDAQ is using technological means to bridge the gap between the two. For all market participants, adapting to this new normal of "high-frequency, around-the-clock, tokenized" trading will be key to survival in the future.

2025 may very well be the inaugural year of a new era for U.S. stocks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。