Author: Lawyer Liu Zhengyao

Introduction

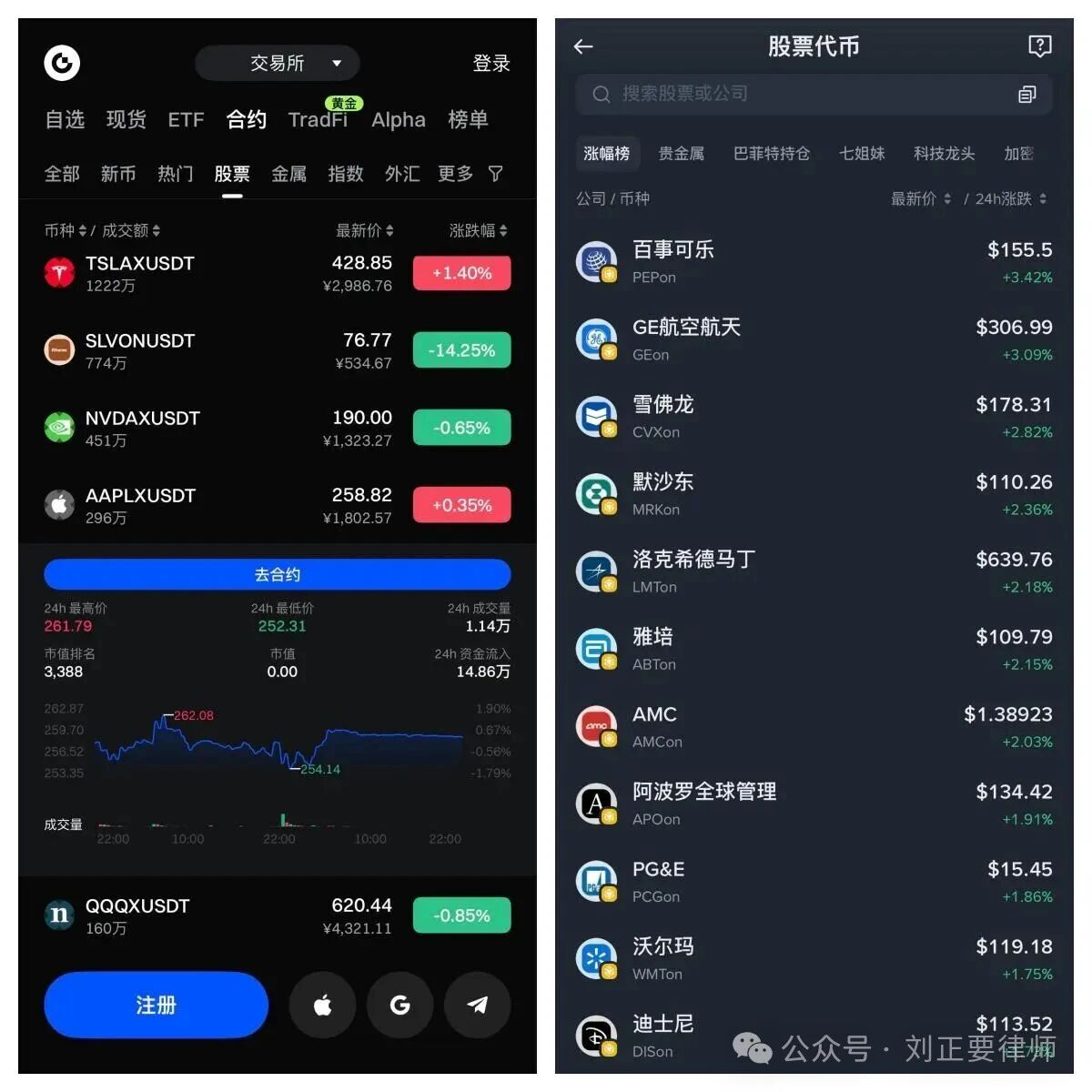

Recently, major virtual currency exchanges have begun to successively launch stock token products, and some exchanges even have precious metal tokens.

For example, Binance has launched Tesla's stock token, and Gate Exchange has also introduced stock tokens for Apple, Nvidia, and other U.S. stocks. Additionally, there are familiar U.S. stock tokens for Pepsi, Merck, Walmart, and more. Interestingly, Tesla's token can be leveraged up to 10 times. For those accustomed to 100x leverage in contracts, 5x or 10x leverage might seem trivial, but for traditional U.S. stock investors, it feels like putting a Ferrari engine in a tractor.

As a Web3 lawyer, today, Lawyer Liu will discuss the legal risks associated with the stock tokens launched on virtual currency exchanges.

01 Why are exchanges rushing to issue U.S. stock tokens now?

In the current crypto market, if we set aside the sorrow of retail investors, even the compassionate among us must sympathize with the exchanges. The current crypto market has liquidity as dry as the Sahara Desert. Let's analyze from three perspectives:

First, the helplessness of stock game. Previously, "one day in the crypto world is like a year in the real world," but now everyone is either "lying flat" or "cutting each other." New retail investors are growing slowly, and seasoned investors have become more astute, leading to a significant decline in trading volume for exchanges, making life difficult.

Second, the desire to "break out." To retain users, exchanges must introduce something fresh. By "tokenizing" U.S. stocks, they essentially aim to attract traditional stock investors who find trading cryptocurrencies too esoteric but want to experience 24/7 trading and high leverage.

Finally, the influence of the "everything can be tokenized" mindset. In the eyes of "Web3 fundamentalists," putting real-world assets (RWA) on the blockchain is a trend. However, this time the step taken is a bit too big, directly touching the most sensitive nerve of "securities law." Currently, mainland China has temporarily closed the door on RWA. (For details, see Lawyer Liu's previous article "Thirteen Ministries and Seven Associations Issue Documents to Prevent Virtual Currency Risks, Where is RWA Going?")

02 Perspective of Chinese Criminal Law: Issuing U.S. stock tokens without authorization constitutes a crime

Although discussing the issuance of U.S. stock tokens by overseas virtual currency exchanges under Chinese law is not very meaningful, given the principle of personal jurisdiction in Chinese criminal law, even if some individuals holding Chinese passports are overseas, Chinese criminal law can still apply (provided these individuals plan to return to China).

According to China's Criminal Law, issuing stock tokens through virtual currency exchanges may involve the following two crimes:

(1) Illegal business operation

According to China's financial regulatory logic, anyone engaging in financial business must have a "license." You cannot claim that you are exempt from the "Securities Law" just because you are wearing a Web3 or virtual currency "vest."

According to Chinese law, engaging in securities business without state approval can constitute illegal business operation. Although stock tokens are called "tokens," they are pegged to stock prices and even have leverage. Based on Lawyer Liu's experience dealing with mainland judicial authorities, this is clearly viewed as a "securities derivative" in the eyes of the judicial system. Operating stock tokens in mainland China without a license is essentially dancing on the edge of the police's KPI.

To elaborate, what constitutes "illegal securities operations" in illegal business operations? Common forms include: engaging in securities brokerage, underwriting, sponsorship, and margin financing without approval and without the corresponding qualifications. For overseas virtual currency exchanges, current mainland regulations prohibit them from operating in mainland China (as their business activities are considered illegal financial activities). However, in practice, many exchanges, especially those with a Chinese background, can directly use mainland networks to log into their apps (although the exchanges do not provide download channels for the mainland internet). At this point, objectively, overseas virtual currency exchanges have indeed engaged in substantial securities issuance activities in mainland China.

(2) Unauthorized issuance of stocks

If illegal business operation is a "catch-all crime," this crime is a more precise one. If a virtual currency exchange claims that these tokens are a type of certificate it issues, relying on real-time comparisons to overseas stock prices and selling them to mainland citizens via the internet, it may also touch upon the "unauthorized issuance of stocks, companies, or corporate bonds." Of course, there are two topics to discuss here: first, do U.S. stock tokens qualify as stocks? Second, even if U.S. stock tokens are considered stocks, do they fall under the stocks regulated by Chinese criminal law (meaning does the "unauthorized issuance of stocks" only protect stocks in mainland China and not overseas stocks)?

From the perspective of a criminal defense lawyer, I personally believe that mainland criminal law should not be "too broad" and that the issuance of overseas stocks should not be targeted as "unauthorized issuance of stocks." However, based on existing case law, some courts believe that even issuing overseas stocks constitutes unauthorized issuance of stocks under Chinese criminal law.

03 Do ordinary players face legal risks when purchasing U.S. stock tokens?

For ordinary players, purchasing U.S. stock tokens on virtual currency exchanges carries the following legal risks:

(1) "Willing to gamble, willing to lose," the law does not protect you

According to the well-known "9.24 Notice" in the crypto world, activities related to virtual currencies are classified as "illegal financial activities." Investments in virtual currencies by mainland citizens fall into the realm of self-risk, and Chinese law does not provide protection.

Moreover, there is a painful reality: If the Nvidia token you bought skyrockets by 10 times, but the exchange "pulls the plug," or your account gets frozen, and you go to court to sue, the judge will likely greet you with a kind smile (or possibly argue with you) and then tell you that your case will not be accepted.

(2) Risks of capital inflow and outflow

To trade stock tokens, you need to deposit funds, right? Generally, people have to buy USDT or other virtual currencies through OTC merchants, which involves the legal risks that mainland residents can never avoid when it comes to capital inflow and outflow.

In the current regulatory environment, virtual currency OTC trading is like a minefield. You never know if the person selling you coins, "Zhang San," has their coins or money just transferred from some telecom fraud den. Once you get involved, your bank card might receive a "freeze gift pack," and in severe cases, you could even be listed as a suspect in a crime and called in by the police for "tea."

(3) The "illusion" under leverage

5x leverage sounds appealing, but don't forget, where are the underlying assets of these tokens (i.e., the actual stocks)? Did the exchange really buy the corresponding proportion of stocks in the U.S. market? Or did they just change a number in the background and play a "single-player game" with you?

In the absence of regulatory audits, these tokens are essentially "private servers" created by the exchange. Since it's a private server, the GM (administrator) can change the data however they want. You might think you are betting on Apple's future, but in reality, you are betting on the character of the exchange. Even if you encounter "price manipulation" or "pulling the plug," these people are overseas, and it would be difficult to have your case accepted if you report it to the police.

The following image is Binance's disclaimer regarding stock tokens.

04 Lawyer Liu's Thoughts

In fact, the charm of Web3 lies in breaking boundaries (decentralization, after all), but the purpose of law is to maintain boundaries. Stock tokens, as a "Frankenstein" product, are technically very appealing but legally very troublesome.

For exchanges, this is a high-difficulty dance on the edge of legality; for practitioners, it may be a job offer with "criminal risks"; and for ordinary players, it feels more like an extreme sport without insurance.

In summary: Innovation is good, but never mistake a "legal vacuum" for a "lawless land."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。