Xstocks is a tokenized stock product launched by the Swiss fintech company Backed Finance, aimed at transforming traditional stocks into digital assets through blockchain technology, thereby integrating cryptocurrency with traditional financial markets. Here are its core points:

1. Basic Concepts

Tokenized Stocks: Xstocks converts stocks of U.S. publicly listed companies such as Apple (AAPL), Tesla (TSLA), and Nvidia (NVDA) into digital tokens on the blockchain (e.g., AAPLx, TSLAx). Each token is backed by a 1:1 real stock asset held by Backed Finance, with prices synchronized in real-time with the corresponding stocks.

Trading Method: Users can purchase tokens using cryptocurrencies (such as USDT, BTC) on partner exchanges without the need for a traditional stock account.

2. Operational Mechanism

Underlying Technology: Based on the Solana blockchain, it utilizes its high throughput and low transaction costs (approximately $0.01 per transaction) to achieve efficient trading.

Asset Custody: Backed Finance is responsible for purchasing and holding the actual stocks, ensuring that the tokens are strictly anchored to the underlying assets, and supports users in redeeming tokens for cash value.

Trading Venues: Platforms include centralized exchanges like Kraken and Bybit, as well as DeFi protocols in the Solana ecosystem (such as Raydium and Jupiter), where users can trade, engage in collateralized lending, or provide liquidity.

3. Core Advantages

24/7 Trading: Supports trading around the clock (prices are synchronized only during U.S. stock market hours, with pauses on weekends and holidays), breaking through traditional U.S. stock trading time limitations.

Low Barriers and Costs: No need for cross-border brokerage accounts, commission-free (on Kraken), with settlement times reduced to near real-time, lowering friction in cross-border investments.

DeFi Compatibility: Tokens can be stored in crypto wallets for use in decentralized finance scenarios (such as collateralized lending and liquidity mining), expanding asset utilization scenarios.

4. Risks and Limitations

Regulatory Risks: Due to non-compliance with U.S. SEC regulations, participation is prohibited for U.S. users; it is only open to users in Europe, Asia, Latin America, and other regions.

Loss of Rights: Token holders do not enjoy traditional stockholder rights such as voting rights.

Technical and Credit Risks: There are risks of smart contract vulnerabilities, platform bankruptcies (referencing the FTX case), or asset decoupling, relying on the credibility of the custodian.

5. Market Impact

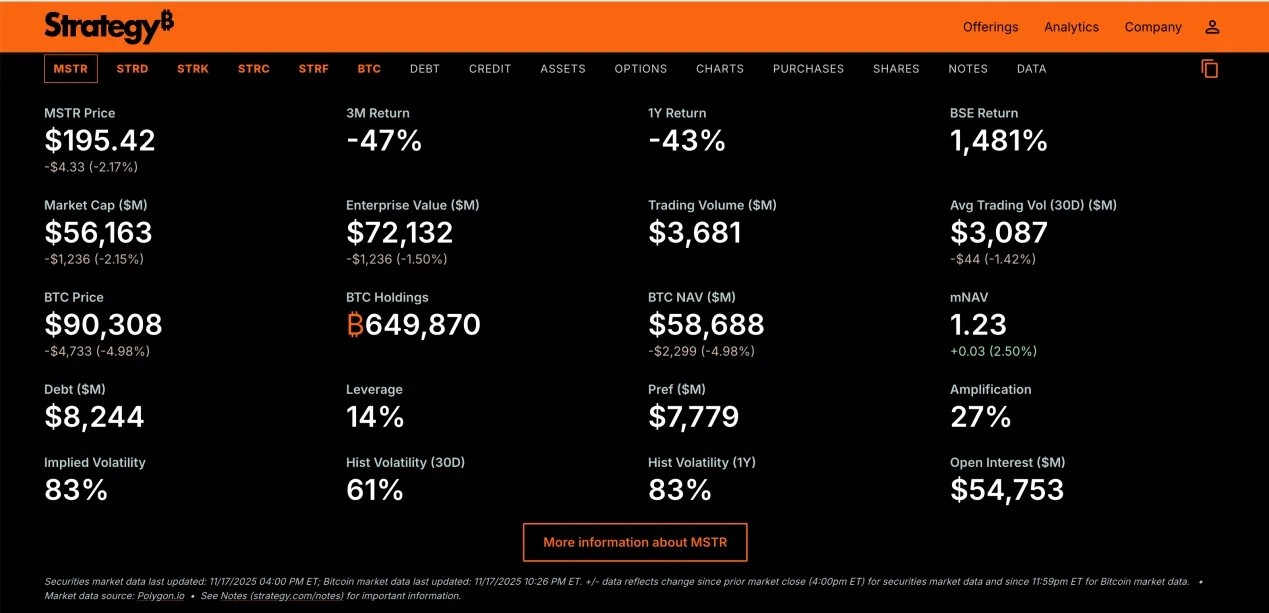

Promoting RWA (Real World Asset) Tokenization: It serves as a benchmark case for the integration of traditional finance and the crypto ecosystem, potentially increasing liquidity in U.S. stocks (with expected trading volume increases of 10-15% for stocks like Tesla).

Challenging Traditional Finance: Disrupting the role of brokerage intermediaries, encouraging institutions like Nasdaq to explore blockchain settlement systems.

Conclusion

Xstocks essentially represents a blockchain mapping of traditional stocks, enabling global investors to trade U.S. stocks with cryptocurrencies 24/7 while integrating into the DeFi ecosystem. Its innovation lies in breaking down geographical and temporal barriers, but it is essential to remain vigilant about regulatory and technical risks. If a compliant framework is established in the future, it could reshape global asset trading models.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。