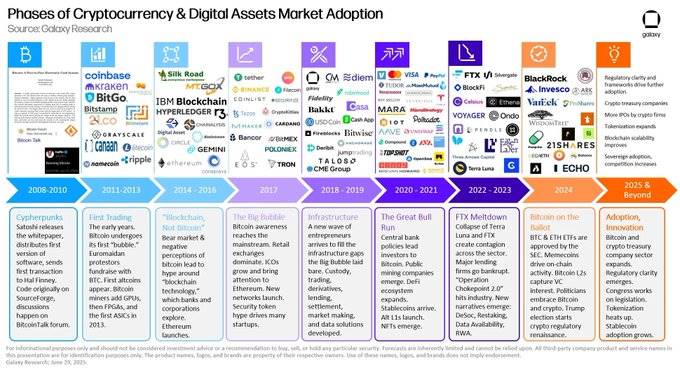

The momentum for change is becoming increasingly evident, and as the pieces of the puzzle gradually come together, now is a critical moment to deeply understand the blockchain industry.

Author: Heechang Four Pillars

Translation: Deep Tide TechFlow

Key Points

The Task Force for Executive Order 14178 released a 166-page report today outlining how the United States is leading the blockchain industry and welcoming the "Crypto Golden Age."

The core content of the report can be summarized in four key points: (i) Establishing a unified classification framework for the digital asset market; (ii) Interconnectivity between the banking industry and the blockchain industry; (iii) Accelerating the adoption of stablecoins; (iv) Developing guidelines for illegal financial activities and taxation.

In the real world, the momentum for change is becoming increasingly evident. The collaboration between traditional financial institutions (such as JPMorgan) and blockchain-based platforms (such as Coinbase and Robinhood) is showcasing an important trend towards practical financial innovation.

Although countries like the United States are leading in this field, South Korea should also take more action and maintain an open attitude—essentially saying, "Let’s seriously study and try to understand all of this." Only by starting to understand now can we avoid being left behind in the wave of rapid change.

1.Recognizing Blockchain Trends and Leading the Way

In the United States, the government is actively recognizing the potential of blockchain and digital assets and is vigorously promoting it. On January 23, 2025, President Donald Trump issued Executive Order 14178, "Strengthening America's Leadership in Digital Financial Technology," which established clear regulatory guidelines and encouraged innovation in the field. According to this order, the Task Force for Executive Order 14178 released a 166-page report today outlining how the United States is leading the blockchain industry and welcoming the "Crypto Golden Age."

The report reviews the United States' long tradition of technological innovation and assesses how blockchain and digital assets (cryptocurrencies) could fundamentally change the financial system and asset ownership structure. It also points out that overly restrictive measures, such as the previous administration's so-called "Operation Choke Point 2.0," have excluded legitimate and compliant crypto companies from the banking system. The report suggests that the government should actively support business activities related to these innovative technologies in the future rather than suppress them.

In the spirit of Executive Order 14178, the report emphasizes that U.S. regulators should promote innovation through clear and consistent rules and attract crypto companies to operate domestically. The report urges agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to collaborate in establishing clear standards and a unified classification framework to eliminate regulatory gaps. At the same time, the report suggests adopting a technology-neutral and flexible regulatory approach in emerging areas such as decentralized finance (DeFi) to ensure that innovation is not hindered by outdated rules.

Source: Strengthening America's Leadership in Digital Financial Technology—The White House

Meanwhile, Hong Kong has also responded quickly, following suit. In June 2023, the Hong Kong government officially implemented a licensing system for virtual asset exchanges, aimed at regulating cryptocurrency trading while allowing retail investors to participate to a limited extent. In May 2025, the bill passed the Asia's cutting-edge "Stablecoin Act", which establishes licensing requirements for institutions issuing stablecoins pegged to fiat currencies. It will officially take effect on August 1, 2025. Thanks to this "regulatory and innovation-friendly coexistence," Hong Kong is expected to promote blockchain development and become one of Asia's leading digital asset centers.

2. Key Information from the Report "Strengthening America's Leadership in Digital Financial Technology"

Since the Trump administration took office, the sentiment towards cryptocurrencies in the United States has changed. A survey conducted as of June 2025 shows that 72% of cryptocurrency investors support President Trump's related policies, and more than one-fifth of Americans now hold some form of cryptocurrency. Among these investors, 64% stated that the government's pro-crypto stance makes them more inclined to invest in cryptocurrencies than before. This optimistic sentiment is also spreading to institutional investors: a poll shows that 83% of institutional investors plan to increase their allocation to digital assets in 2025.

These data indicate that a more favorable regulatory environment is injecting new vitality into the crypto industry. Under the government's slogan of "supporting responsible innovation and growth," the report repeatedly emphasizes that by implementing friendly crypto policies and establishing a clear regulatory environment, the United States is expected to seize a leading position in the upcoming blockchain revolution.

The core content of the report can be summarized in four key points. Let’s delve into each one.

2.1 Establishing a Unified Classification Framework for the Digital Asset Market

This section discusses the legal and regulatory classification of digital assets and methods to improve market structure. Currently, there is no clear standard in the United States to define whether a particular cryptocurrency is a security or a commodity. This ambiguity has led to jurisdictional conflicts between regulatory agencies (such as the SEC and CFTC) and left regulatory overlaps. The report points out, "The lack of a comprehensive classification framework has led to a chaotic array of interpretations, making good-faith participants trying to comply with regulations feel like they are walking through a minefield," highlighting the urgent need for a clear and unified classification system for digital assets.

For example, digital tokens used for fundraising may be considered securities (investment contracts) when sold, but once they become sufficiently decentralized, some believe they should no longer be regarded as securities. Currently, there is no standard that can account for this dynamic change throughout a project's lifecycle. This creates significant uncertainty for projects, as they find it difficult to predict which laws will apply over time.

In this context, the report endorses the proposed "Digital Asset Market Clarity Act" (CLARITY Act). This act was passed in the U.S. House of Representatives in 2025 with bipartisan support. The CLARITY Act categorizes digital assets into security tokens and non-security (commodity) tokens, clearly granting the SEC jurisdiction over the former and the CFTC jurisdiction over the latter and the cryptocurrency spot market. The act also includes provisions to protect Americans' rights to self-custody assets and engage in peer-to-peer trading, recognizing the value of decentralized governance and decentralized finance (DeFi).

The report states that the CLARITY Act will lay a solid foundation for "the structure of the U.S. digital asset market," but also suggests some improvements during the legislative process. First, the report emphasizes the need to clarify the legal status of fully decentralized protocols. It provides legislators with several factors to consider, such as:

Whether the given software protocol exerts any actual "control" over user assets;

Whether the protocol can be technically altered or upgraded;

Whether there are centralized operators or governance structures;

And whether current regulatory obligations can be technically enforced.

Given these standards, the report believes that truly decentralized projects cannot be regulated like traditional intermediaries, thus requiring a new approach. Regulators should develop a flexible framework that achieves policy goals while avoiding stifling innovation.

The report hopes that the CLARITY Act can provide a foundation in this regard and urges Congress to swiftly enact the legislation. It also suggests that before the act is officially implemented, regulators should use existing authority to take immediate action to provide greater regulatory transparency for market participants.

2.2 The Banking Industry and Blockchain Industry Should Interconnect

This section explores the integration of the banking industry and the cryptocurrency industry and offers policy recommendations on how U.S. banks can expand their participation in digital assets under prudent regulation. The report mentions the previous administration's actions to cut off banking services to cryptocurrency companies—referred to as "Operation Choke Point 2.0"—and criticizes it as a misguided attempt to stifle development by pushing legitimate industries away from the banking system.

The report points out that this top-down pressure has led many U.S. cryptocurrency companies to face issues such as having their bank accounts closed, resulting in unintended side effects like consumer harm and the growth of unregulated "shadow" markets.

The report emphasizes that banks can significantly improve efficiency and reduce costs by utilizing blockchain technology. For example, integrating distributed ledgers into payment and settlement systems can enable real-time payments and atomic settlements around the clock, eliminating business hour restrictions and reducing costs associated with central clearinghouses. Some large banks are already moving in this direction, testing their digital dollar tokens or blockchain platforms for bond settlements.

Recommendations proposed in this section of the report include:

Clarifying the crypto-related activities allowed for banks and restoring initiatives like the Office of Innovation to provide guidance for banks in this area.

Enhancing the transparency of bank licensing approval and Federal Reserve account application processes to facilitate the entry of new enterprises while avoiding unfairly blocking existing banks from serving crypto clients;

Aligning bank capital requirements with actual risks and developing regulatory guidance for new risk exposures such as tokenized assets.

2.3 Stablecoins Should Be Viewed as Innovative Digital Tools and Actively Promoted

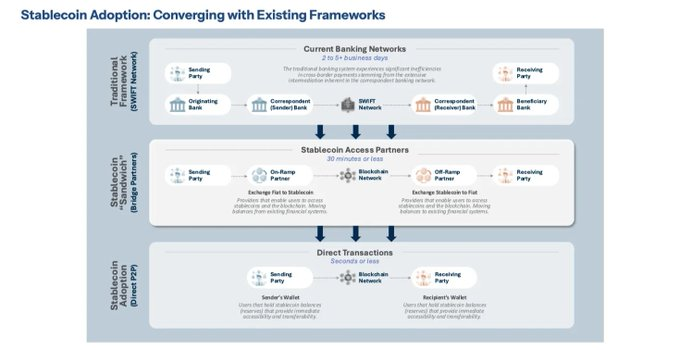

This section focuses on stablecoins in the context of digital payment innovation and how they reinforce the dominance of the U.S. dollar. Stablecoins are a type of cryptocurrency designed to maintain a stable value, pegged 1:1 to fiat currencies like the U.S. dollar. Due to their low price volatility, they effectively serve as digital cash within the crypto ecosystem.

The report assesses that the widespread use of stablecoins pegged to the U.S. dollar can modernize payment infrastructure and help the United States move away from its increasingly aging traditional payment networks. For example, using stablecoins for international remittances or securities settlements can achieve near-instant processing without intermediary banks and significantly reduce costs. This will also enhance the international influence of the U.S. dollar. Currently, dollar-based stablecoins account for a significant share of global cryptocurrency trading volume, with a circulation scale reaching hundreds of billions of dollars. The report emphasizes that to lead this trend, the U.S. must establish a clear federal regulatory framework for stablecoins.

In this context, the report highlights the "Guiding and Establishing the National Innovation Act for U.S. Stablecoins," abbreviated as the "GENIUS Act," which was passed by the U.S. Congress this year. The GENIUS Act (i) establishes a system for private dollar stablecoin issuance institutions approved and regulated by the Federal Reserve; (ii) prohibits the Federal Reserve from creating a central bank digital currency (CBDC), thereby clearly favoring private sector-led digital dollar innovation. The report praises the GENIUS Act for "incorporating a framework conducive to innovation into federal law" and strongly urges the Treasury Department and other relevant agencies to implement the act seriously and promptly.

The report also points out that while establishing stablecoin rules, addressing tax issues is also crucial. Under current U.S. tax law, the definition of stablecoins is unclear, and their tax treatment may vary depending on whether they are viewed as currency or property. The report notes that this ambiguity burdens participants, and therefore, once the federal stablecoin regulatory system is in place, tax laws should be updated to clarify the classification of stablecoins, thereby eliminating uncertainty.

The core message of this section can be summarized as: "Actively promote stablecoins as a means of digital dollar innovation, firmly reject central bank digital currencies (CBDCs), as they threaten American freedom and financial stability." Regarding stablecoins, the report urges strict enforcement of the newly enacted GENIUS Act and suggests additional legislation if necessary to strengthen privacy protection and consumer safeguards.

The report also emphasizes that the U.S. should lead the establishment of global standards for stablecoins and promote innovation in cross-border payments.

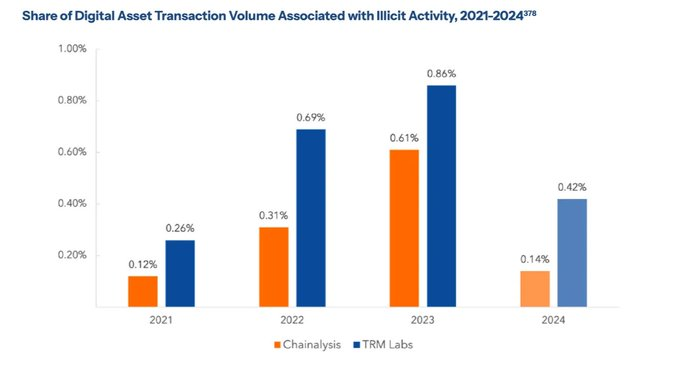

2.4 Guidelines Must Be Established for Illegal Financial Activities and Taxation

This section discusses the illegal financial risks associated with cryptocurrencies (such as money laundering, terrorist financing, tax evasion, etc.) and the measures to address them. The report begins by stating, "To embrace innovation while ensuring national security, we must modernize anti-money laundering (AML) regulations," and analyzes the vulnerabilities in the current system.

Due to the anonymity, borderless nature, and real-time execution of cryptocurrency transactions, the report acknowledges that enforcing laws designed for traditional banking, such as the Bank Secrecy Act (BSA) or the "Travel Rule," faces challenges. For example, criminals may use decentralized exchanges or mixing services to repeatedly exchange or split funds, making transactions difficult to trace. The report cites specific cases—such as North Korean hacker groups abusing decentralized finance (DeFi) in 2022 and ransomware attackers demanding cryptocurrency payments—to illustrate that the current AML mechanisms need updating to address these new strategies.

At the same time, the report repeatedly emphasizes that AML and counter-terrorist financing (CFT) enforcement must not be abused or deviate from the law's original intent. If AML regulations are used for political purposes or to suppress specific industries, it will only undermine public trust in the financial system. Therefore, regulatory agencies themselves should operate under democratic oversight and transparency, clearly articulate guidelines, and avoid imposing unfair restrictions on legitimate businesses and users.

The final part of this section proposes recommendations to address the ambiguities and uncertainties related to the taxation of digital assets. The report points out that although the Internal Revenue Service (IRS) generally classifies cryptocurrencies as property, specific tax guidelines for new activities such as staking, mining, airdrops, or token wrapping have not yet been established, leading to significant confusion for taxpayers. The report urges the IRS and the Treasury Department to issue clearer and more practical tax guidance and suggests considering a tax exemption for small cryptocurrency transactions to prevent users from being penalized for using cryptocurrencies for everyday payments.

3. Helping More People Better Understand Cryptocurrencies

Source: X (@glxyresearch)

Many countries and companies (the United States being a typical example) are racing to announce and implement blockchain strategies, not merely to follow trends but because they have anticipated market developments and prepared in advance. In the U.S., companies like Messari, Delphi, Galaxy Research, and rwa.xyz have consistently provided high-quality research to help institutions formulate forward-looking strategies for blockchain and digital assets. Protocols like Ondo Finance and Morpho have built secure on-chain financial services, while companies like BitGo and Coinbase provide reliable infrastructure for institutions to invest in crypto assets.

In contrast, South Korea's basic understanding and preparation for the blockchain industry (especially regarding stablecoins) remain insufficient. Discussions about stablecoins still focus on the failure of Terra or debates about why stablecoins are unfeasible, with arguments revolving around issuance issues rather than practical applications. However, stablecoins have demonstrated various use cases globally, and efforts should not only focus on issuance but also on developing products that integrate them into daily life. Achieving this goal requires policy support and a clear regulatory environment.

Since the blockchain industry (especially stablecoins) is still in its early stages, it is challenging to cite specific success stories to justify their application. However, this makes it all the more crucial to maintain an open attitude—essentially saying, "Let’s seriously examine and try to understand it." Only by starting to understand now can we keep pace with rapid changes.

4. The Puzzle is Gradually Coming Together, and the Future is Coming into View

The boundaries between finance and blockchain are beginning to blur, and leading companies from both sides are starting to collaborate. A typical example is the partnership between the largest bank in the U.S., JPMorgan Chase, and the cryptocurrency exchange Coinbase. JPMorgan Chase will allow its credit card customers to redeem reward points for USDC on Coinbase's Base blockchain and directly connect customer accounts with the Coinbase platform, enabling seamless, near-instant exchanges between fiat and cryptocurrencies. This marks a milestone integration between traditional banks and cryptocurrency exchanges, indicating that major financial institutions now view digital assets as a legitimate component of their financial services.

This trend is not limited to banks and exchanges. Coinbase has also partnered with Morpho to expand into the on-chain finance space, specifically decentralized finance (DeFi). Through this collaboration, users can deposit their held Bitcoin via the Coinbase app and use it as collateral to borrow USDC for everyday expenses. This demonstrates an asset utilization strategy that traditional finance cannot achieve. In fact, investors can continue to hold Bitcoin while managing their daily cash flow, indicating that blockchain-based financial innovation has entered a practical stage.

New developments are also emerging in the fintech sector. The popular trading platform Robinhood is launching its own Layer-2 blockchain to provide infrastructure for on-chain issuance and trading of listed and private stocks. The Robinhood Chain will eventually connect to the Ethereum ecosystem. This means that fintech platforms can not only provide brokerage services but also leverage their own blockchain to handle a broader range of on-chain financial assets. In short, a new trend is forming: traditional fintech platforms are adopting blockchain technology to achieve asset ownership and liquidity that were previously unattainable.

Unfortunately, compared to these global financial innovation cases, South Korea remains behind. There has yet to be substantial cooperation or integration initiatives among South Korean banks, exchanges, fintech startups, and DeFi projects. Perhaps South Korean institutions need to at least try using private blockchain platforms (such as JPMorgan's private Kinexis network) to gain practical experience. Major countries and financial institutions worldwide have begun to outline blockchain-driven financial blueprints and actively engage in collaboration. If South Korea continues to stagnate, domestic discussions will inevitably remain at a theoretical level and fail to translate into practice.

Of course, implementing blockchain is not easy, and it is understandable to proceed cautiously when its market impact is still unclear. However, avoiding issues due to uncertainty or indefinitely delaying action is not the best choice. The transformation of the financial system driven by blockchain has already begun, and pioneers are learning quickly and accelerating their progress. The only question left is when and how others will choose to join this wave.

The momentum for change is becoming increasingly evident, and as the pieces of the puzzle gradually come together, now is a critical moment to deeply understand the blockchain industry—also the best time to seriously consider and take action to adopt blockchain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。