As blockchain data becomes increasingly refined, even non-insiders can now make institutional-level predictions—an advantage that was once exclusive to Wall Street analysts.

Author: Kevin Li

Translation: Deep Tide TechFlow

Our analyst Kevin Li estimates Coinbase's revenue for the second quarter at $1.495 billion, a decrease of 6.2% compared to Wall Street's estimate of $1.594 billion.

July 31 Earnings Update:

Author's Estimate: $1.495 billion (-$20 million)

Wall Street Expectation: $1.594 billion (+$97 million)

Actual Value: $1.497 billion

Key Points:

Real-time revenue forecasting using on-chain data: We estimate Coinbase's second-quarter revenue at $1.495 billion, below Wall Street's expectation of $1.594 billion, based on publicly available blockchain data.

Despite market downturn, trading revenue remains dominant: Trading revenue is expected to reach $710 million, still Coinbase's largest source of income, but both institutional and retail trading volumes declined in the second quarter as the Memecoin market gradually cooled.

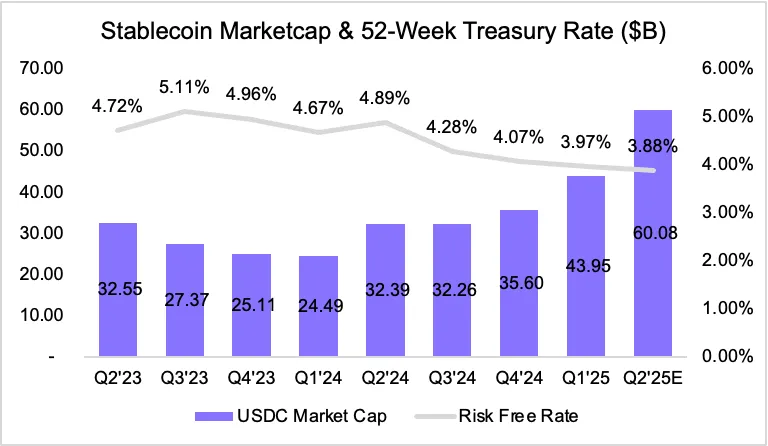

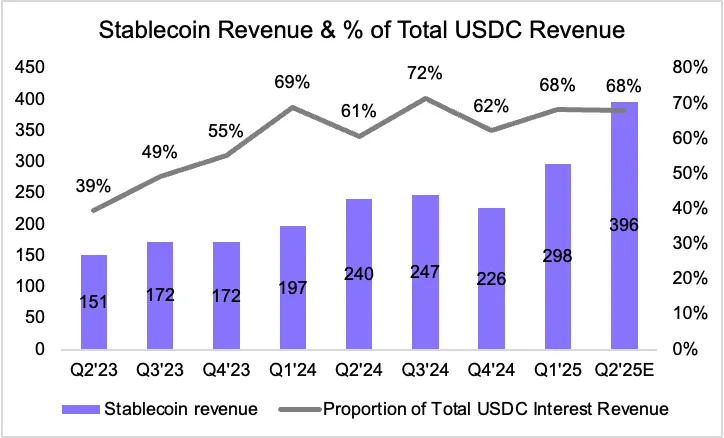

Explosive growth of stablecoins drives revenue: The supply of USDC increased by 36.7% to $60 billion, with stablecoin revenue surging to an estimated $396 million, becoming the second-largest contributor to revenue.

Layer 2 and interest income provide significant boosts: The Base network is expected to generate $57.82 million, including on-chain fees and estimated non-fee income; blockchain rewards (primarily ETH staking) contributed $159 million; interest income and subscription services brought in $72 million and $117 million, respectively.

A core advantage of cryptocurrency/blockchain is its transparency, allowing us to estimate revenue from blockchain-related businesses in real-time.

In traditional finance (TradFi), analysts cannot know a company's quarterly performance in advance unless it is related to consumer spending, which can be analyzed using credit card panel data. However, in the crypto space, everything is recorded on-chain and can be publicly verified. This allows anyone to analyze blockchain data and predict a company's fundamentals in real-time. In this article, we will detail how to use on-chain activity to forecast Coinbase's revenue.

Coinbase's revenue is divided into several main components:

Trading Revenue

Base Network Revenue

Blockchain Rewards Revenue

Stablecoin Revenue

Other and Subscription Revenue

Interest Income

Trading Revenue

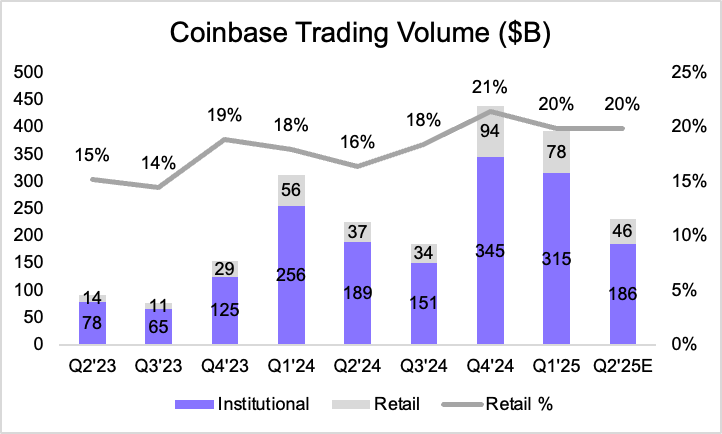

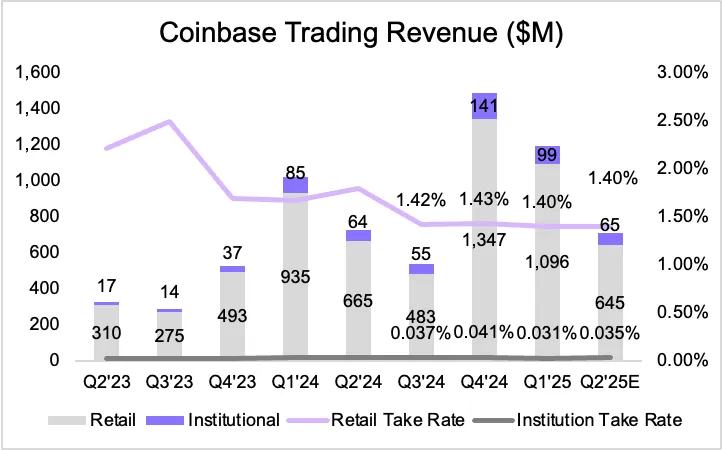

Coinbase's trading activity can be observed through on-chain data, making it relatively simple to estimate trading-related revenue. In the second quarter, Coinbase's total trading volume was $232 billion, a 41% decrease from the first quarter. This decline reflects the overall cooling of the crypto market, especially after the Memecoin market lost momentum related to the Trump election narrative. The trading volume saw a particularly significant drop in the latter half of the second quarter. Retail trading has consistently accounted for 18%-20% of total trading volume. For the second quarter, we used the upper limit of 20% for estimation.

Applying a 1.4% fee rate to the retail trading portion, we estimate retail revenue at $645 million. For institutional clients, we assume a slight increase in the fee rate to 0.035% to reflect Coinbase's derivatives services, estimating revenue at approximately $65 million. Overall, total trading revenue is expected to reach $710 million.

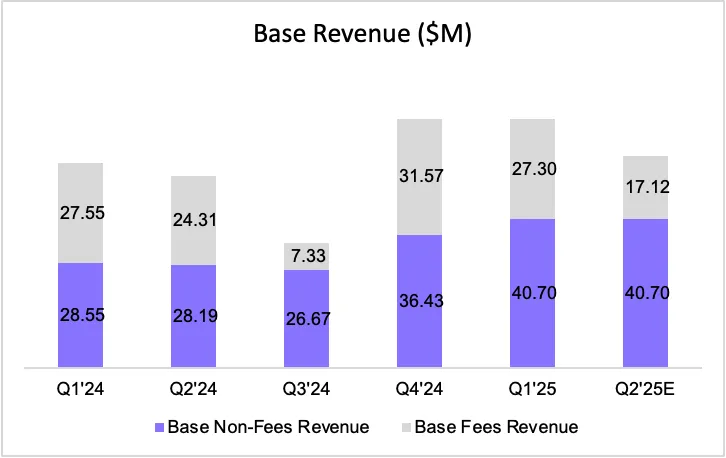

Base Network Revenue

Coinbase's Layer 2 network, Base, earns revenue through transaction fees and other potential non-fee income sources. On-chain data allows us to directly track fee income, and we estimate the fee income for the second quarter at $17.12 million. However, the revenue reported by Base has consistently exceeded the total on-chain fee amount, indicating it may come from B2B partnerships or infrastructure support. Assuming non-fee income remains at $40.7 million (based on data from recent quarters), the total revenue for Base in the second quarter is expected to be $57.82 million.

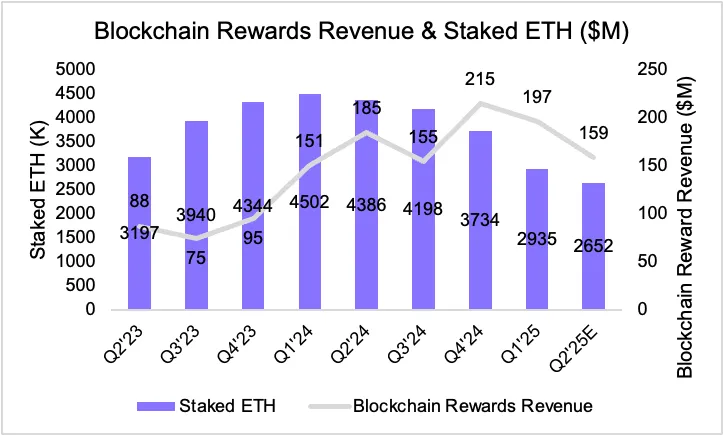

Blockchain Rewards Revenue

Coinbase offers staking services for various assets. To simplify the analysis, we use staked ETH as a representative for estimating blockchain rewards revenue. On-chain data shows that the amount of staked ETH at Coinbase decreased from 2.935 million to 2.652 million in the second quarter, likely due to redemptions and staking rebalancing.

Based on this ETH price range and average reward assumptions, we estimate blockchain rewards revenue at approximately $159 million. While this is just an approximation, this method captures the trend of this revenue stream.

Stablecoin Revenue

The stablecoin business conducted through USDC was the main growth driver in the second quarter. The market cap of USDC soared to $60 billion, a quarter-over-quarter increase of 36.7%. To estimate the reserve yield, we used the 52-week U.S. Treasury yield, which slightly decreased from 3.97% to 3.88%. Despite the decline in interest rates, the surge in USDC supply was sufficient to offset the impact of the rate drop.

Coinbase's share of total revenue from USDC has fluctuated between 62% and 72% in recent quarters. Using a median of 68% as a benchmark, we estimate the revenue related to stablecoins in the second quarter at $396 million.

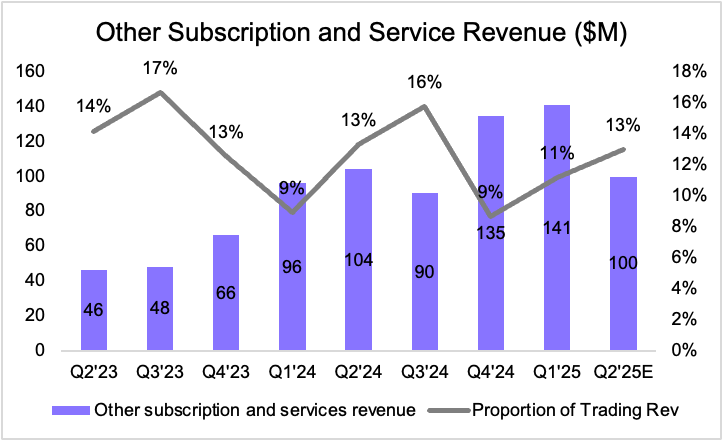

Other Subscription and Service Revenue

This revenue segment includes Coinbase One (its premium subscription product) and custody fees—especially services provided for ETF clients. We view this revenue as a function of total trading activity. Multiplying it by 13% of trading revenue, we estimate the second-quarter revenue at $100 million, consistent with the overall decline in trading volume, down 29% quarter-over-quarter.

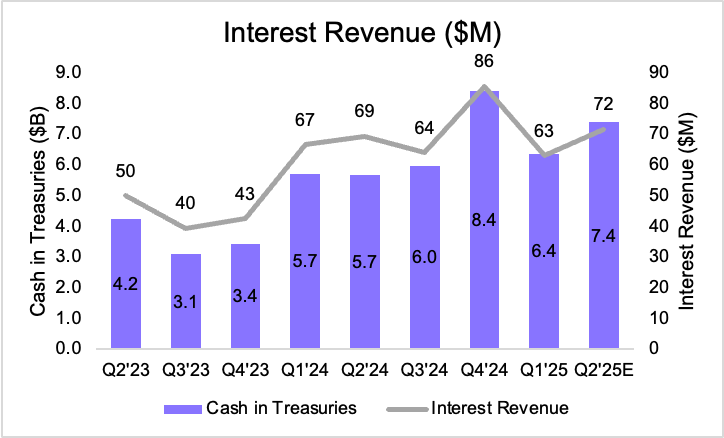

Interest Income

Finally, the cash and Treasury securities held by Coinbase can earn interest. Using the same 52-week U.S. Treasury yield as a benchmark, we estimate the interest income for the second quarter at $72 million. This represents a 12% increase from the previous quarter, primarily due to the growth of Coinbase's Treasury position rather than changes in yield (which has slightly declined).

Conclusion: Comprehensive Analysis

By leveraging on-chain data, we can construct a detailed and timely estimate of Coinbase's quarterly revenue before the official financial report is released. Summarizing all key business segments:

Trading Revenue: $710 million

Base Network Revenue: $57.82 million

Blockchain Rewards Revenue: $159 million

Stablecoin Revenue: $396 million

Other Subscription and Service Revenue: $117 million

Interest Income: $72 million

This brings our forecast for Coinbase's total revenue in the second quarter to $1.495 billion, slightly lower than Wall Street's expectation of $1.594 billion.

While some metrics rely on proxies and assumptions, the overall model demonstrates the powerful potential of on-chain transparency. As blockchain data becomes increasingly refined, even non-insiders can now make institutional-level predictions—an advantage that was once exclusive to Wall Street analysts.

The author of this article and affiliated companies of Artemis Analytics may have economic interests in the protocols or tokens mentioned. This article does not constitute investment advice or a recommendation to buy, sell, or hold any assets. The information provided is for reference only and should not be the basis for financial, legal, or tax decisions. Readers should assess their own circumstances before making any financial choices. The views expressed in this article may change at any time without notice, and Artemis Analytics is not responsible for any losses incurred from the use of this content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。