The more I look at oracles, the more I feel a sense of approaching the essence.

Everyone is familiar with MEV, but not many know about OEV.

MEV, according to previous definitions, stands for Miner Extractable Value; while OEV stands for Oracle Extractable Value.

There are two rules: those with extra information can always gain extra profits; however, the more people who know the extra information, the thinner that profit will be rolled.

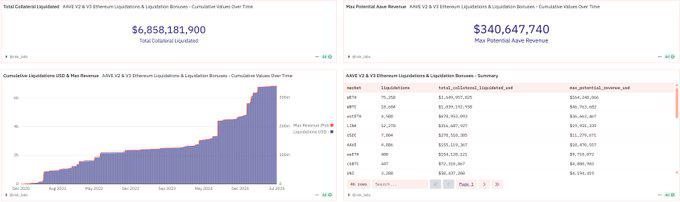

For example, in the liquidation of AAVE, the protocol incentivizes third parties to liquidate by offering them a liquidation reward, say 10% of the liquidation amount.

This is essentially a guaranteed profit business, and those footing the bill are the liquidated parties who either have no money or forgot to top up their margin.

So can you imagine how things would develop in a public, profitable opportunity? Initially, it was on an hourly basis, waiting for someone to manually liquidate; then it became a minute-level competition, with scripts racing for speed to grab orders; finally, it reached a second-level competition, where robots had to rely on burning Gas War to compete for the right to be prioritized on-chain.

The result of the Gas War is that these robots must pay over 90% of the amount to miners to win a small share.

Of course, miners (nodes) are the happiest, lying back and doing nothing, not even having to bear the blame of being liquidation vultures, comfortably accepting 90% of the income.

However, where there are competitors, there are even more competitors. When second-level is still not enough, the battle spreads to the oracle level.

Everyone thinks about it, realizing that the ones who can see liquidation information the earliest are actually the oracles. After all, if the oracle says you are liquidated, then you are truly liquidated; if the oracle does not say you are liquidated, you might not even be liquidated.

For example, suppose Alice's Ethereum price is 2999 and is about to be liquidated. If the oracle raises the price by an inch and forcibly reports it as 3000, and then Ethereum happens to reverse at the integer level, it might just save Alice's position.

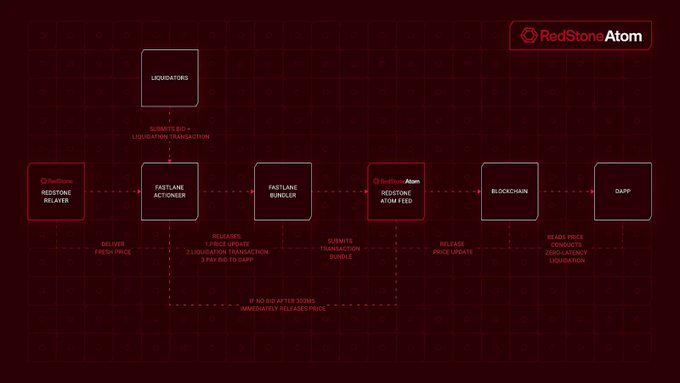

So how does this competition move from second-level to millisecond-level? For example, take RedStone's newly released Atom feature.

In the same bankruptcy liquidation scenario, it can provide oracle data off-chain and conduct a small auction off-chain.

And the liquidator can handle it directly off-chain, no longer needing to burn Gas War; the highest bidder wins, roughly in 300 milliseconds.

After each auction ends, Atom directly submits the bids to the smart contract based on the bid amounts (bypassing public channels).

Moreover, this smart contract is quite interesting; it packages three operations into one atomic transaction:

Update the signed oracle price;

Execute the liquidation;

Transfer the winning amount to the designated recipient.

Since the three operations are settled within the same block, the oracle update and liquidation are directly tied together and inseparable, thus eliminating the possibility of other liquidators seeing this on-chain information and immediately copying it to liquidate first.

This operation of binding three transactions together on-chain is indeed quite clever, but upon reflection, it embodies standard blockchain thinking—time in the blockchain world is not linear but is measured in blocks, for example, Ethereum is 12 seconds.

Theoretically, these three transactions occur simultaneously, so no one can insert any transactions in between; it has exhausted the limits of this matter.

Thus, this OEV war, after RedStone Atom, has directly moved from second-level to millisecond-level, reaching the finish line of the competition in one step. Starting to run at the finish line makes it meaningless for others to try to jump ahead.

Moreover, because this liquidation runs off-chain, it may even be faster for the protocol compared to the past.

The profits captured by OEV can also be fed back to the protocol, the oracle itself, and the liquidators, benefiting all three parties. I believe this will face minimal resistance in promotion, making it a great design.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。