166-Page Cryptocurrency Report is Not Just "Paperwork"

Source: The White House

Compiled by: KarenZ, Foresight News

On July 31, Beijing time, the President's Working Group on Digital Assets at the White House released the report "Strengthening U.S. Leadership in the Digital Financial Technology Space."

The report spans 166 pages, covering an overview of the digital asset ecosystem, digital market structure, and the current regulatory framework, providing over 100 relatively clear legislative recommendations and guidelines on digital asset classification, payment stablecoins, regulatory frameworks, taxation, etc. The core goal is to ensure the United States maintains its global leadership in the digital asset and blockchain technology fields and to promote the establishment of a clear regulatory framework to foster innovation, protect consumers and investors, while mitigating financial risks.

TL;DR

1. U.S. citizens and businesses should be able to own digital assets and use blockchain technology for legitimate purposes without fear of being prosecuted. Similarly, U.S. entrepreneurs and software developers should have the freedom and regulatory certainty to leverage these technologies to upgrade all sectors of the U.S. economy.

Congress should enact legislation confirming that individuals can hold their digital assets without financial intermediaries and use these assets for legitimate peer-to-peer transactions.

Congress should codify principles regarding how asset control affects obligations under the Bank Secrecy Act, particularly concerning money transmitters. For the Bank Secrecy Act, software providers that do not maintain complete independent control over value should not be considered as engaging in money transmission.

The Financial Crimes Enforcement Network (FinCEN) should assess whether and how its existing guidance related to digital assets (including guidance issued in 2013 and 2019) should be rescinded, modified, or updated to reflect legislative and regulatory changes. FinCEN may consider whether additional guidance is needed for specific markets or the application of specific Bank Secrecy Act obligations.

2. Policymakers and market regulators should lay the groundwork for the U.S. digital asset market to become the deepest and most liquid market in the world.

The SEC and CFTC should leverage their existing authority to immediately promote digital asset trading at the federal level.

Congress should enact legislation granting the CFTC explicit authority to regulate the spot market for non-securities digital assets. This legislation should allow registrants of both market regulators to engage in multiple lines of business under the most efficient licensing structure.

Policymakers should fully consider the extent to which specific software applications in determining DeFi regulation: (i) exercise "control" over assets; (ii) can be technically modified; (iii) operate in a centralized structure or management; (iv) can technically or logistically comply with current regulatory obligations.

3. Bank regulators should promote the development of digital assets and blockchain technology.

Federal bank regulators should ensure that existing and new practices or guidelines regarding risk management and bank participation are technology-neutral.

These regulators should restart cryptocurrency innovation initiatives. The U.S. should adopt capital requirements that accurately reflect the risks of bank digital asset activities.

Relevant federal bank regulators should provide clarity and transparency regarding the process for qualified institutions to obtain bank licenses or reserve bank master accounts.

4. Dollar-backed stablecoins represent the next wave of innovation in the payments space, and policymakers should encourage their adoption to enhance the dollar's dominance in the digital age.

All agencies authorized by Congress under the U.S. GENIUS Act should efficiently fulfill their responsibilities.

U.S. agencies, including the Treasury, should promote U.S. private sector leadership in responsibly developing cross-border payment and financial market technologies. These agencies should also promote U.S. leadership in establishing new international laws, regulations, and technical standards and best practices for payment technologies that reflect U.S. interests and values.

Relevant U.S. government departments, including the Treasury, should promote the private sector's leadership role in the responsible innovation of cross-border payment and financial market technologies. These agencies should also push for U.S. leadership in establishing new international laws, regulations, and technical standards and best practices for payment technologies that reflect U.S. interests and values.

Congress should legislate to prohibit the adoption of any central bank digital currency (CBDC) within the United States. At the international level, the U.S. should urge other countries to implement policies that promote the private sector's role in upgrading payment and financial systems.

5. U.S. law enforcement agencies should have the necessary tools and authority to hold accountable those who engage in illegal activities using digital assets. These enforcement tools must not be misused to target the legitimate activities of law-abiding citizens.

6. The President's Working Group on Digital Assets is committed to addressing the tax ambiguity in the digital asset space through clear tax guidelines and legislative adjustments, balancing support for innovation with tax compliance needs.

Specifically covering tax guidance related to token wrapping, mining, staking, payment stablecoins, etc.

Congress should enact legislation treating digital assets as a new asset class and modify tax rules applicable to securities or commodities under federal income tax regulations, adding digital assets to the list of assets subject to wash sale rules.

Overview of the Digital Asset Ecosystem

The report outlines the digital asset ecosystem:

Since the birth of Bitcoin in 2009, the digital asset market has grown exponentially, evolving from a niche area into a multi-trillion-dollar payment and trading ecosystem.

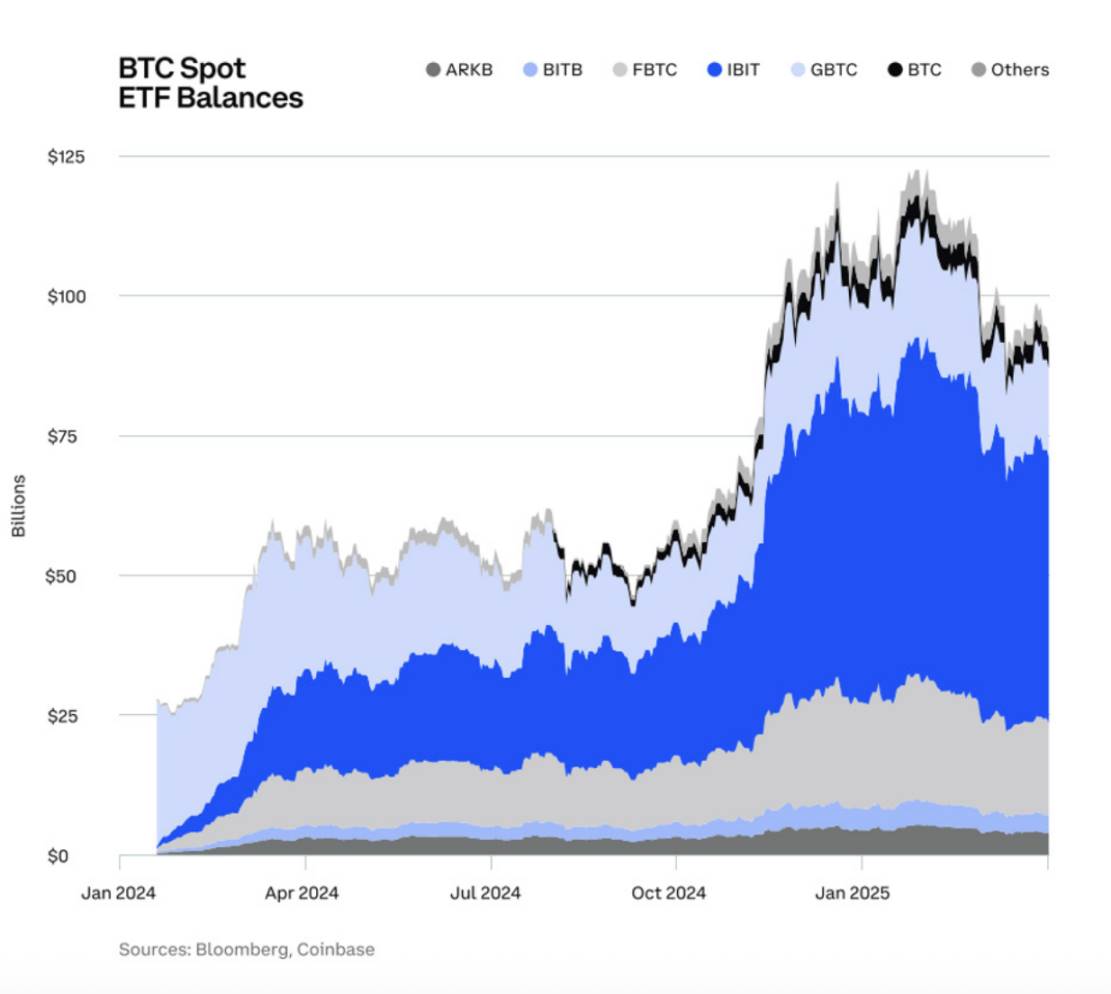

Institutional adoption is accelerating: Bitcoin spot ETF data continues to grow.

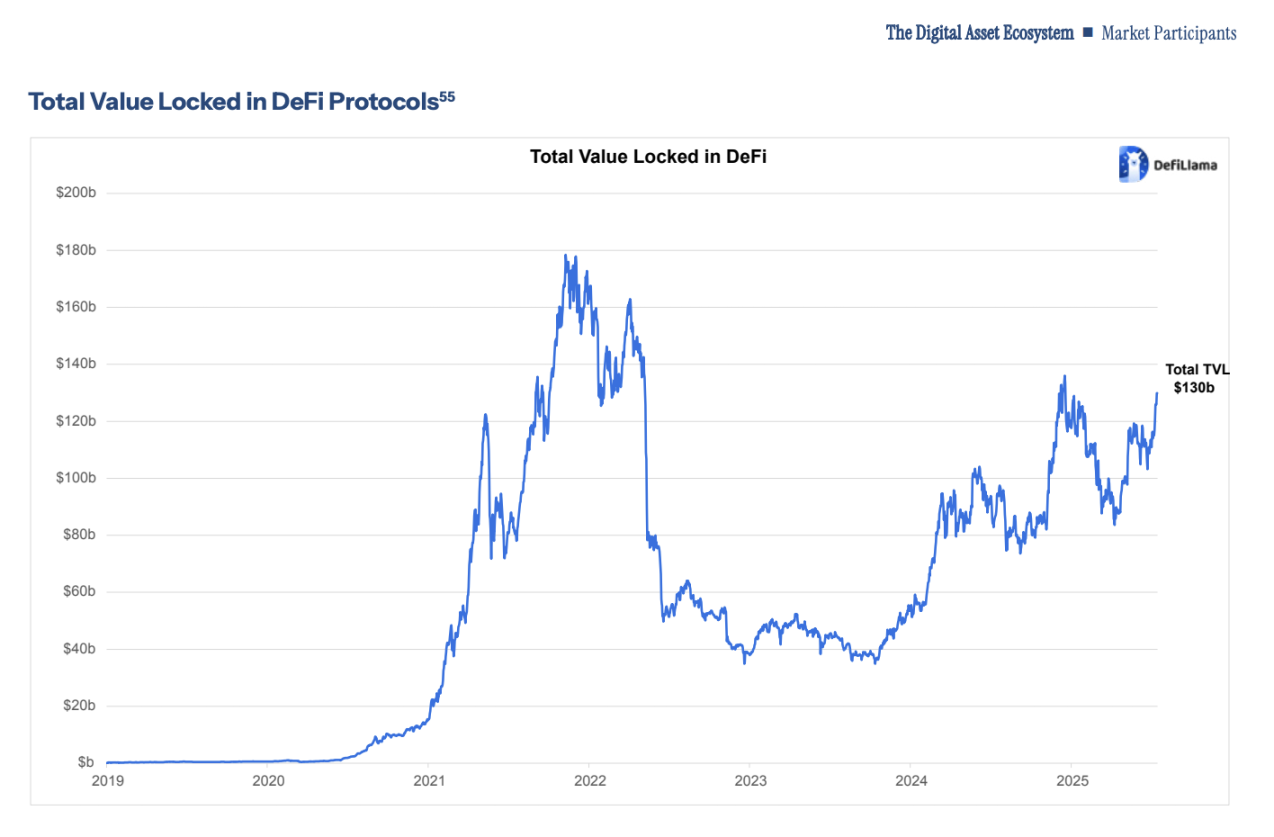

Rise of DeFi: Total value locked (TVL) in DeFi protocols reached $130 billion by 2025.

Various institutions, including sports clubs and video game developers, are beginning to experiment with using NFTs as symbols of loyalty for teams or in-game assets.

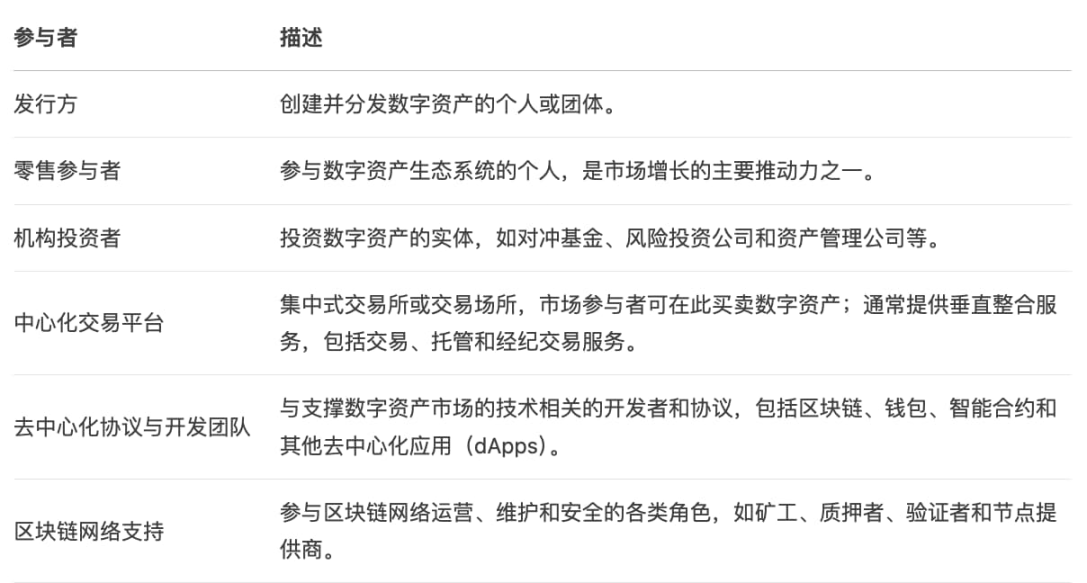

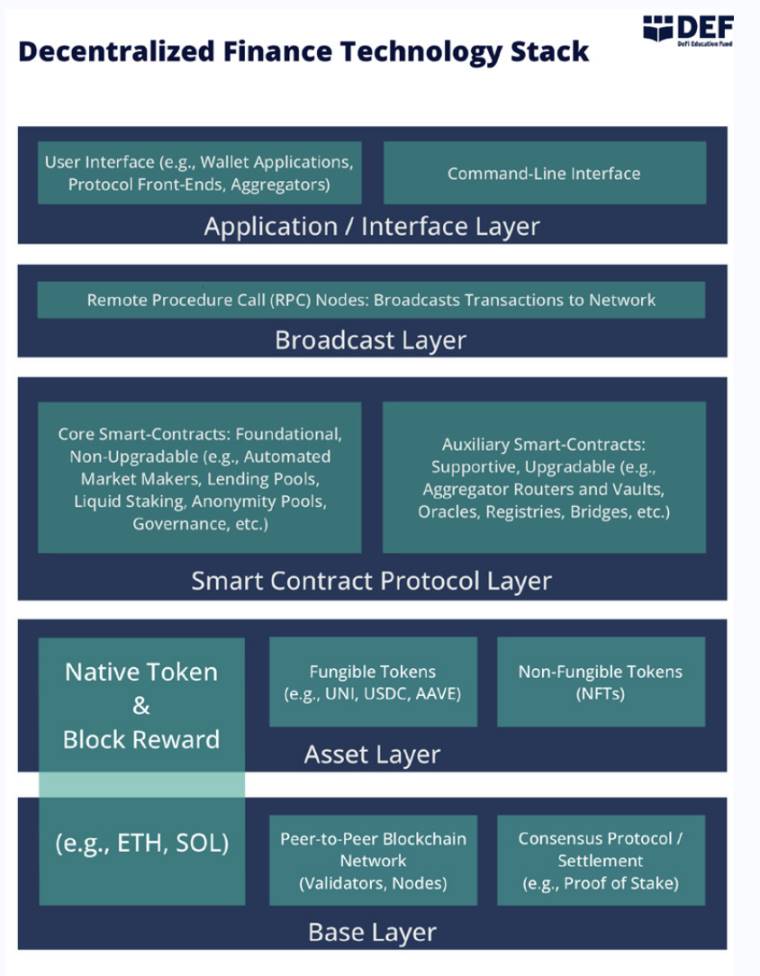

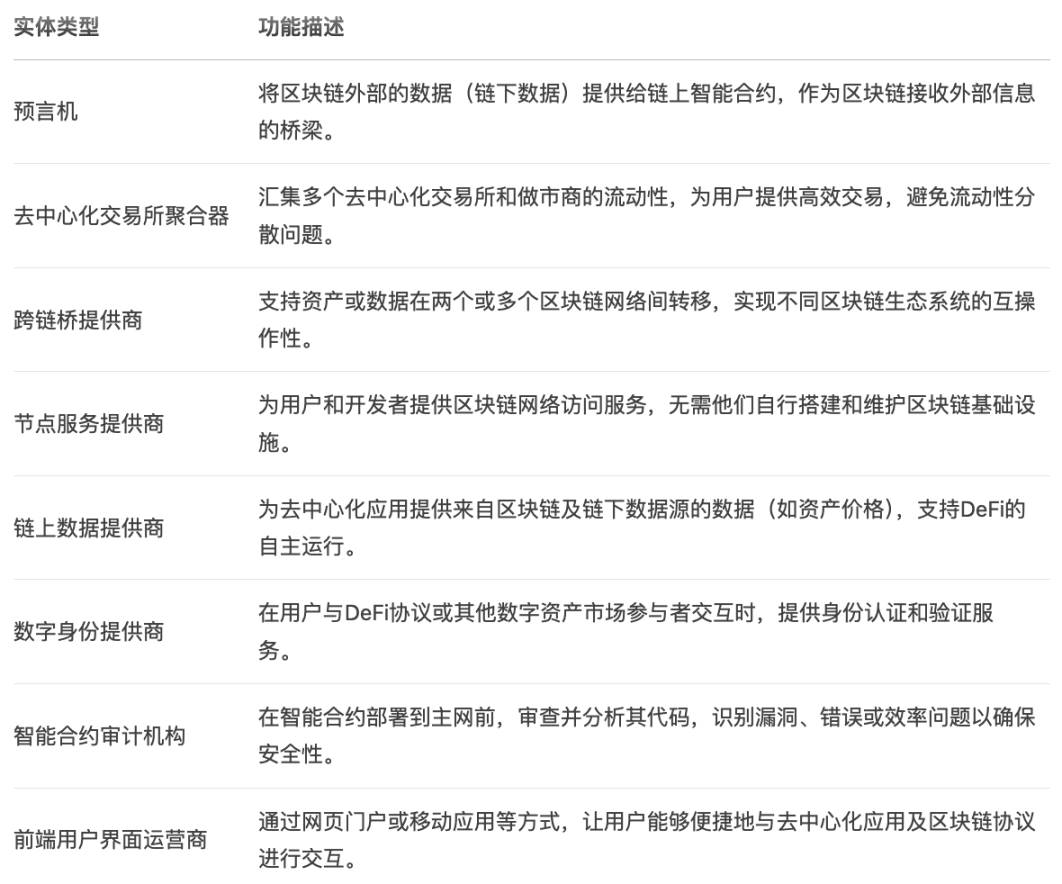

The report also outlines numerous market participants in the digital asset ecosystem, the DeFi technology stack, and introduces DAOs, consensus mechanisms (PoW and PoS), mining, staking, key infrastructure providers, and tools.

Numerous Market Participants:

DeFi Technology Stack:

Key Infrastructure Providers and Tools:

Current Regulatory Framework

Federal Level

The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC): the primary federal regulatory agencies for the secondary digital asset market.

Self-regulatory organizations such as the Financial Industry Regulatory Authority (FINRA) and the National Futures Association (NFA) also assist in regulating and supervising certain financial industry participants.

Bank regulators: Federal Reserve, Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation, National Credit Union Administration (NCUA).

U.S. Department of the Treasury: The Financial Crimes Enforcement Network (FinCEN) requires financial institutions to submit Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) under the Bank Secrecy Act (BSA) to protect the financial system from illegal activities and combat money laundering and terrorist financing; the Office of Foreign Assets Control (OFAC) is the primary agency for U.S. economic sanctions; the Internal Revenue Service (IRS) is responsible for tax collection and providing tax-related assistance to taxpayers.

State Level

Some state financial services agencies have applied state-level money transmission laws to digital asset custodians and trading platforms, requiring intermediaries to register as money transmitters to provide services to customers located in those states. Some states exclude digital asset trading from money transmission laws, meaning companies engaged solely in digital asset trading may not be subject to licensing requirements in those states. Other states have established specific regulatory frameworks for digital assets.

New York (NYDFS): Requires digital asset businesses to obtain a license through the "BitLicense" system, which has been criticized for its lengthy process.

Wyoming: Established a "Special Purpose Depository Institution" (SPDI) license, recognizing DAOs as legal entities.

California: Will implement specialized regulations for digital assets in 2026.

Key Market Activities Requiring Further Regulatory Clarity

The report also discusses key market activities that require further regulatory clarity, including:

Issuance of digital assets (ICOs, airdrops, forks);

Trading;

Custody and wallets;

Clearing and settlement;

Lending and collateralization;

Tokenization.

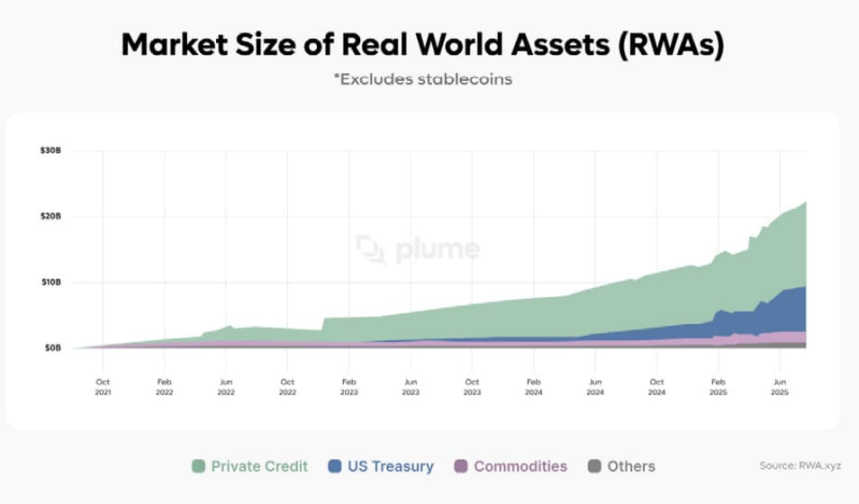

Regarding tokenization, the report cites industry estimates that by 2030, over $600 billion of "real-world assets" could be tokenized. The regulatory structure for tokenization depends on the asset being tokenized rather than the tokenization process itself. In places where tokenization tools are regulated, they are often regulated as securities, as a significant portion of current tokenization trading volume comes from securities-type underlying assets (e.g., fixed income and private credit). Other non-securities uses of tokenization include tokenized commodities (e.g., gold) and tokenized non-financial assets (e.g., commercial real estate and rare items).

Market Structure and Regulatory Recommendations

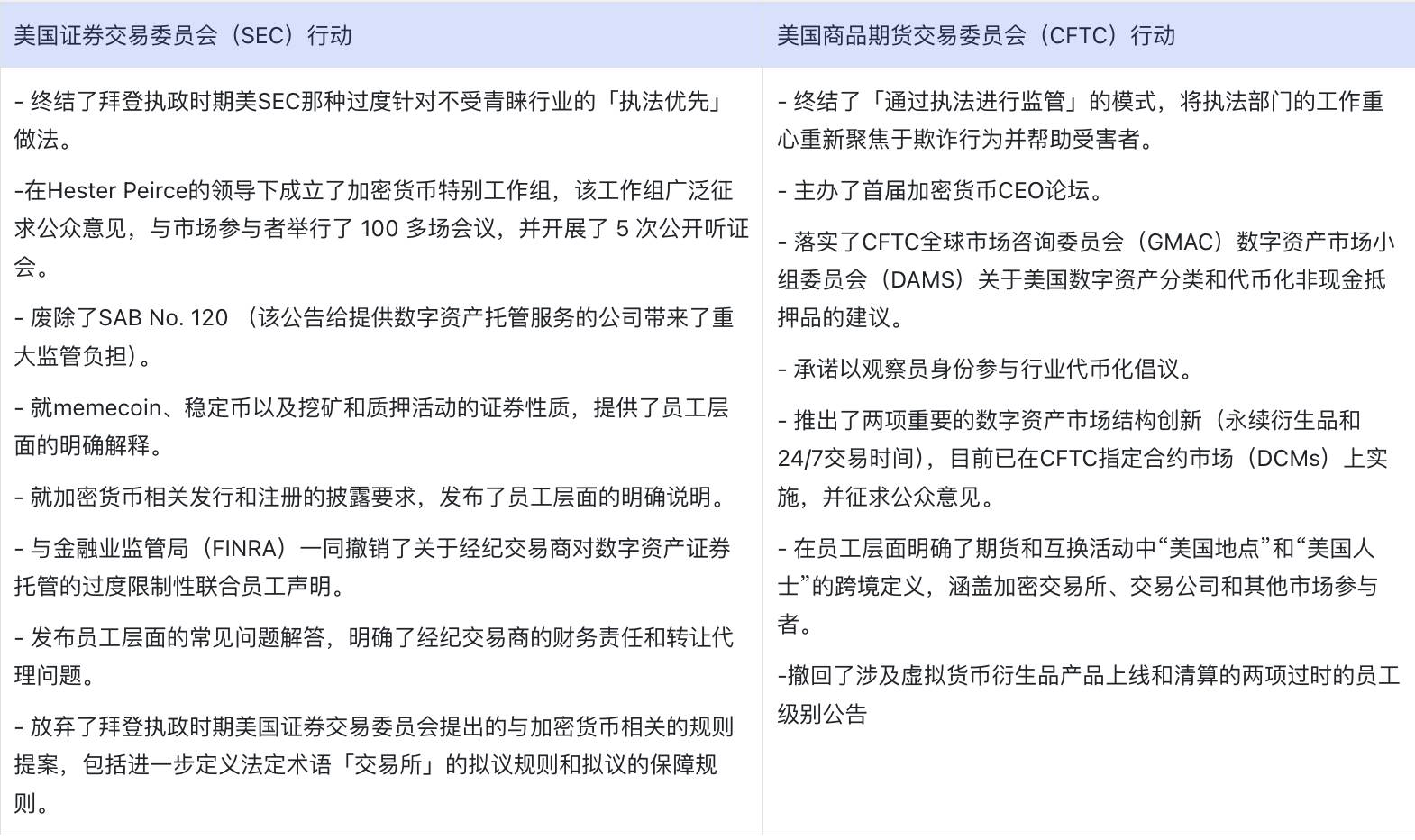

The report notes that since Trump's inauguration, both the SEC and CFTC have taken strong initial steps to provide much-needed clarity for market participants.

Establishing a Digital Asset Classification System

The report categorizes digital assets into three types: security tokens, commodity tokens, and tokens for commercial and consumer use.

1. Security Tokens

Definition: Assets that meet the definition of "securities" under the Securities Act, such as stocks, bonds, or investment contracts (determined by the Howey test).

Regulatory Requirements:

Issuers must register with the SEC or meet exemption conditions.

Under Section 3(a)(1) of the Securities Exchange Act and accompanying Rule 3b-16(a), any platform that meets the definition of "exchange" and provides trading services for security tokens must register as a national securities exchange or operate under an exemption (e.g., as an ATS).

Tokenization does not affect the substance of the securities issued, and the use of blockchain by the issuer or its agents does not create new or different types of assets. Therefore, tokenized securities fully comply with the federal securities law definition of "securities," and unless exempted, all such asset issuances and sales must be registered. The SEC has the authority to grant exemptions to alleviate concerns related to the issuance and trading of tokenized securities.

2. Commodity Tokens

Definition: Digital assets considered "commodities" by the CFTC (such as Bitcoin and Ethereum), whose derivatives (futures, options) are regulated by the CFTC.

Regulatory Requirements: There is currently no federal uniform framework for the spot market, but the CFTC can combat fraud and manipulation. If digital asset derivatives are involved, they must be traded on designated contract markets (DCMs) or swap execution facilities (SEFs) and comply with CEA clearing rules. Digital asset derivatives will be cleared by registered derivatives clearing organizations (DCOs), which act as the central counterparty for each buyer and seller.

Network tokens (protocol tokens) differ from securities and typically do not grant equity, debt, or profit-sharing rights. Even if network tokens are initially issued as "investment contracts" (securities), once the network is fully operational and sufficiently decentralized, they should no longer be considered securities.

3. Tokens for Commercial and Consumer Use

Definition: Tokens used to access specific goods, services, or rights (often NFTs), or loyalty tokens (which can be redeemed for consumption purposes within a closed system).

Federal-Level Regulatory Recommendations to Promote Digital Asset Trading

I. Recommendations for Immediate Actions by the SEC:

- Utilize the rulemaking and exemption authority under the Securities Act to advance the following measures:

Establish a customized exemption system for securities issuance involving digital assets.

Create a temporary safe harbor for tokens that are functionally incomplete or not fully decentralized, allowing them to develop gradually without being bound by securities laws.

Establish a safe harbor for specific airdrop activities to avoid being classified as "sales" under Section 2(a)(3) of the Securities Act, or exempt them from registration requirements under Section 5 of the Securities Act. Additionally, consider exemptions for digital asset distributions by decentralized physical infrastructure (DePIN) providers to incentivize network participation, as well as for specific NFT issuances.

- Utilize the rulemaking and exemption authority under the Securities Exchange Act to advance the following measures:

Allow non-security digital assets (excluding payment stablecoins) linked to investment contracts to be traded on non-SEC registered trading platforms after the initial distribution is completed.

Provide exemptions for specific DeFi service providers from the registration requirements of the Securities Exchange Act regarding brokers (Section 15), exchanges (Sections 5 and 6), and clearing agencies (Section 17A).

Revise the ATS regulations (or establish a similar framework) to better coordinate the parallel trading of non-security digital assets and securities under a regulatory framework suitable for digital asset trading.

Establish conditional "innovation exemptions" under the Securities Exchange Act to allow SEC-registered entities to engage in innovative business models.

Redefine the term "facility" in Section 3(a)(2) of the Securities Exchange Act to accommodate new business models for digital asset trading.

Revise the NMS regulations and related national market system plans to promote:

Tokenization of NMS securities

Parallel trading of non-security digital assets with NMS securities

Optimization of quoting/order collection mechanisms and trading reporting requirements

Support for the application of oracles, aggregators, and other DeFi components in NMS securities or non-security digital asset trading

Update transfer agent rules to explicitly allow the use of blockchain technology.

Clarify under what circumstances self-custody wallet providers must register as brokers.

- Utilize the Investment Advisers Act and Investment Company Act to advance:

Clarify the custody requirements for registered investment companies/investment advisers regarding security tokens.

Assess whether certain state-chartered trust companies should be included in the category of "qualified custodians."

II. Recommendations for Immediate Actions by the CFTC

- The CFTC should consider utilizing its rulemaking, interpretive, and exemption authority under the Commodity Exchange Act to advance:

Provide clear guidance for designated contract markets (DCMs) regarding leverage, margin, or financing-type retail commodity spot trading (involving digital assets).

Clarify the criteria for determining whether digital assets may be classified as commodities.

If digital asset investment tools or their managers may be classified as "Commodity Pools" or need to register as "Commodity Pool Operators" (CPOs), the CFTC will update relevant rules as necessary.

Collaborate with FinCEN to develop new regulations that provide guidance for qualified intermediaries and other market participants on implementing customer identification programs (CIPs) using new technologies.

Allow institutions to provide bundled trading and custody services.

Clarify the applicability of DeFi activities, smart contract protocols, and DAOs under the existing CFTC registration framework (following the principle of technological neutrality).

Guide futures commission merchants (FCMs) in calculating and managing segregation obligations when holding digital assets.

Clarify the valuation discount rules for registered intermediaries (including FCMs, swap dealers, and derivatives clearing organizations) holding digital assets for margin calculations, capital and financial resource reporting, and settlement obligations.

Review the standards for recognizing digital assets as qualified collateral under CFTC Rule 1.49.

Develop collateral guidelines for derivatives clearing organizations (DCOs) regarding digital assets (including payment stablecoins), covering:

DCO financial resource requirements

Asset valuation and margin discounts

Settlement finality

Self-custody and third-party custody handling

End-of-day reporting for 24/7 traded assets

Legal risks of netting and collateral rights.

Promote the use of tokenized non-cash collateral as compliant margin.

Clarify the classification standards for digital asset swaps and their margin, reporting, and other requirements.

The SEC and CFTC should coordinate to ensure an efficient rulemaking process and seek public input on rulemaking proposals.

Regarding long-term planning, the SEC and CFTC should explore providing flexibility to allow registered entities to offer multiple services within a single user interface. The CFTC should consider how to modify existing rules to allow the use of blockchain-based derivatives.

For example, combining exchange services with asset custody can enable real-time settlement. By integrating exchange and brokerage services, the same technology stack can be used to process customer orders directly, achieving economies of scale and reducing operational complexity. However, exchanges and intermediaries must separate customer property from their own funds.

What Should Congress Consider in Digital Asset Market Structure Legislation?

The report indicates that Congress should consider the following when finalizing market structure legislative provisions to ensure the most cost-effective and innovation-friendly regulatory structure for digital assets.

1. Division of Responsibilities Among Regulatory Agencies:

The CFTC should be explicitly granted regulatory authority over the spot market for non-security digital assets.

SEC and CFTC-registered entities should be able to conduct diverse business lines under an efficient licensing framework to avoid regulatory arbitrage. SEC-registered entities should be able to provide trading in digital asset securities and engage in non-security digital asset trading under a licensing structure defined by Congress. CFTC-registered entities should be able to provide trading in digital commodity derivatives, retail digital commodity trading, and other CFTC-jurisdiction products, as well as non-security digital assets designated by Congress.

Federal law should take precedence over state law, unifying the applicability of securities and commodities-related regulations.

2. Intermediary Regulatory Framework:

Digital asset trading platforms, brokers, etc., should register with the SEC or CFTC based on their business nature, with rules aligned with existing financial regulatory standards but not overly stringent.

Allow institutions to engage in lending, hedging, and other operations involving securities and non-security assets under controlled risk.

Digital asset trading platforms and other intermediaries should publish standards for managing the onboarding of digital assets and highlight information such as token economics.

Digital asset trading platforms, brokers, dealers, and other entities registered with the SEC and CFTC must disclose their roles when acting on behalf of clients, principals, or counterparties.

3. DeFi Regulatory Principles: Regulation should focus on the control of user assets by protocols, code modifiability, and the degree of centralization, avoiding the imposition of traditional financial rules on non-compliant technological entities. Encourage the development of a balanced framework that fosters innovation and safety while preventing legal circumvention when integrating DeFi into the mainstream financial system.

4. Improvement of Accounting Standards: The Financial Accounting Standards Board (FASB) needs to further clarify the recognition/derecognition standards for digital assets (accounting issues arising from lending, wrapping, and trading) and issues related to the accounting of token issuers.

Banking and Cryptocurrency

Banks currently provide a variety of services to digital asset companies:

Various traditional banking products and services, such as commercial deposit accounts, loans, and capital market advisory services;

Payments;

Tokenization;

Tokenized deposits;

Digital asset custody;

Promote digital asset trading;

Digital asset-related lending, etc.

Report Recommendations:

I. Restart the Bank Crypto Innovation Support Program

1. Prioritize High-Demand Areas

Expand the list of compliant digital asset businesses that banks can engage in within the legal framework.

Ensure fairness in business permissions for banks of different license types.

Develop prudent regulatory standards for the following areas: private chain/public chain applications, deposit tokenization, and the entities conducting core banking operations (deposit institutions or holding companies).

2. Initial Key Topics

Digital asset custody: Supplement technical best practice guidelines (e.g., key management, cold/hot wallet segregation).

Third-party collaboration: Clarify that banks can outsource digital asset services (e.g., sub-custody, infrastructure support).

Stablecoin reserve management: Update existing OCC rules in conjunction with the GENIUS Act.

Self-operated account holdings: Define the compliance and risk control requirements for banks holding digital assets on their balance sheets.

Innovation pilot programs: Allow deposit institutions to participate in digital asset-related experimental projects.

Tokenization activities: Establish differentiated access rules based on the risk levels of underlying assets (including deposit tokenization).

Public chain usage: Adopt a technology-neutral principle, focusing on business substance risks rather than the technology itself.

II. Encourage Technological Innovation in State Banks

Eliminate restrictive policies:

The Federal Reserve should revoke the "2023 Section 9(13) Policy Guidance and 12 C.F.R. § 208.112" and accompanying guidelines to ensure that state member banks are allowed to explore innovative banking technologies and products.

III. Build a Principled Regulatory Framework

Standardization of risk governance

Regulatory capacity building

Stablecoins and Payments

Legislative Recommendations:

Rapidly implement the GENIUS Act: The Presidential Digital Asset Market Working Group urges all relevant federal agencies, including the Treasury Department, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Federal Reserve, the National Credit Union Administration, the SEC, and the CFTC, to swiftly implement the GENIUS Act as required by law, promote the development of dollar stablecoins, and ensure the smooth implementation of the stablecoin regulatory framework.

The U.S. Treasury and other agencies should support the private sector's leadership in cross-border payments and financial market technologies, promoting international standards that align with U.S. interests and values.

Legislation should prohibit the use of CBDCs in the U.S. and call on other countries to support the private sector's dominant role in payment systems.

Combating Illicit Financing

The report presents a series of regulatory and policy recommendations aimed at combating illicit financial activities (such as money laundering, terrorism financing, etc.), summarized as follows:

Clarify the applicability of the Bank Secrecy Act (BSA).

Strengthen information sharing between the public and private sectors regarding illicit financial risks.

The Treasury and relevant agencies need to provide clear AML/CFT compliance guidance for traditional financial institutions and digital asset service providers, specifying requirements for customer identification (CIP), transaction monitoring, and suspicious activity reporting (SAR).

Combat systemic illicit financial risks.

Protect the rights and interests of legitimate users.

Technical standards and compliance tools.

Taxation

The Presidential Digital Asset Market Working Group is committed to addressing tax ambiguities in the digital asset space through clear tax guidelines and legislative adjustments, balancing innovation support with tax compliance needs.

Priority Guidance

The Treasury Department and the IRS should issue guidance:

Clarify how unrealized gains and losses on digital assets are determined when classified as investment assets in adjusted financial statement income (AFSI).

Address whether trusts holding digital assets, staking these assets, and receiving staking rewards can be considered grantor trusts.

Clarify whether "wrapping" (e.g., converting Bitcoin into a tokenized version on Ethereum) and "unwrapping" transactions constitute taxable events.

Update the IRS's frequently asked questions regarding digital assets.

Set a tax-exempt threshold for small income from digital assets (e.g., airdrops, staking rewards, hard forks) to simplify small tax filings (excluding node operators and digital asset mining taxpayers).

Additionally, future working groups will provide guidance on taxes related to mining and staking, airdrops, NFTs, digital asset losses, and charitable contribution deductions.

Some possible legislation or guidance may also include requiring taxpayers to report foreign digital asset accounts, simplifying reporting requirements under the Income Tax Act, and requiring the reporting of basic information when transferring digital assets between centralized exchanges, as well as requiring digital asset brokers to report information on foreign controllers of certain passive entities.

Priority Legislative Recommendations

Congress should enact legislation to classify digital assets as a new category of assets, subject to a modified version of the securities or commodity tax laws applicable to federal income tax. The code provisions applicable to actively traded alternative digital assets should include: (a) "marked to market," "trading safe harbor," "securities lending," etc. Additionally, Section 1091 (wash sale rules) and Section 1259 (constructive sales) should also apply to digital assets. Alternatively, legislation could explicitly state when digital assets are treated as securities or commodities for federal income tax purposes.

Legislation should be enacted to qualify payment stablecoins for federal income tax purposes, as the GENIUS Act does not address this issue. Given the structural nature of payment stablecoins and the potential gains or losses that may arise upon disposal, classifying them as debt seems most appropriate. If payment stablecoins are treated as debt, legislation should also consider the applicability of existing federal income tax rules that may hinder the widespread use of payment stablecoins as financial assets. In particular, legislation should address wash sale and anti-naked bond rules.

Amend the wash sale rules to include digital assets in the list of assets subject to wash sale rules. If such legislation is enacted, broker reporting requirements should be modified to reflect these changes in wash sale rules. Wash sale rules should not apply to payment stablecoins.

Clarify the tax treatment of digital asset lending to be similar to that of securities lending.

U.S. Bitcoin Strategic Reserve and Digital Asset Stockpiling

Regarding the U.S. Bitcoin Strategic Reserve and digital asset stockpiling, the U.S. Treasury has submitted opinions to the White House on establishing and managing a Strategic Bitcoin Reserve and Digital Asset Stockpile. The Treasury will continue to coordinate with the White House and other members of the working group to advance appropriate follow-up measures to implement the operation of the reserve and stockpile.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。