Written by: Glendon, Techub News

After the market crash on "10.11", the price of Bitcoin has been fluctuating in the range of $110,000 to $116,000 for several days. Today, the cryptocurrency fear and greed index dropped from 34 to 28, indicating that the market is still in a "state of panic." This crash was triggered by Trump's announcement of "a 100% additional tariff on China starting November 1," leading to a leveraged "massacre" and the decoupling of stablecoins, setting a historic record for liquidations, comparable to the market crash in May 2021 and the FTX collapse in 2022. However, unlike previous events, the "10.11" crash does not seem to have directly ended the bull market, as Bitcoin quickly halted its decline after dropping to $102,000 and began to stabilize and recover.

Meanwhile, regarding interest rate cuts, Federal Reserve officials have recently been vocal, sending out important signals. Just yesterday, Federal Reserve Governor Stephen Milan stated at a CNBC event that the recent trade tensions have increased uncertainty about economic growth prospects, making it more urgent for policymakers to accelerate interest rate cuts. Prior to this, Federal Reserve Chairman Powell had hinted to the market that the Fed would implement a second rate cut of 25 basis points later this month.

Interest rate cuts have been an important catalyst for driving the crypto market upward. To date, the crypto market is also in urgent need of new driving forces such as interest rate cuts to prevent the market from falling into a deeper "quagmire" of correction. What positive and negative factors are currently present in the entire market? How long will the impact of this crash last?

Leverage bubble squeezed out, market fundamentals remain intact

Unlike the previous bull market led by traditional retail investors, this round of the bull market is driven by institutional funds, which have relatively stable holdings, thus reducing the risk of continued selling to some extent. At the same time, this crash has primarily cleared out speculative capital and the bubble of excessive leverage (such as 50x long contracts), without destroying the fundamental capital chain of the market.

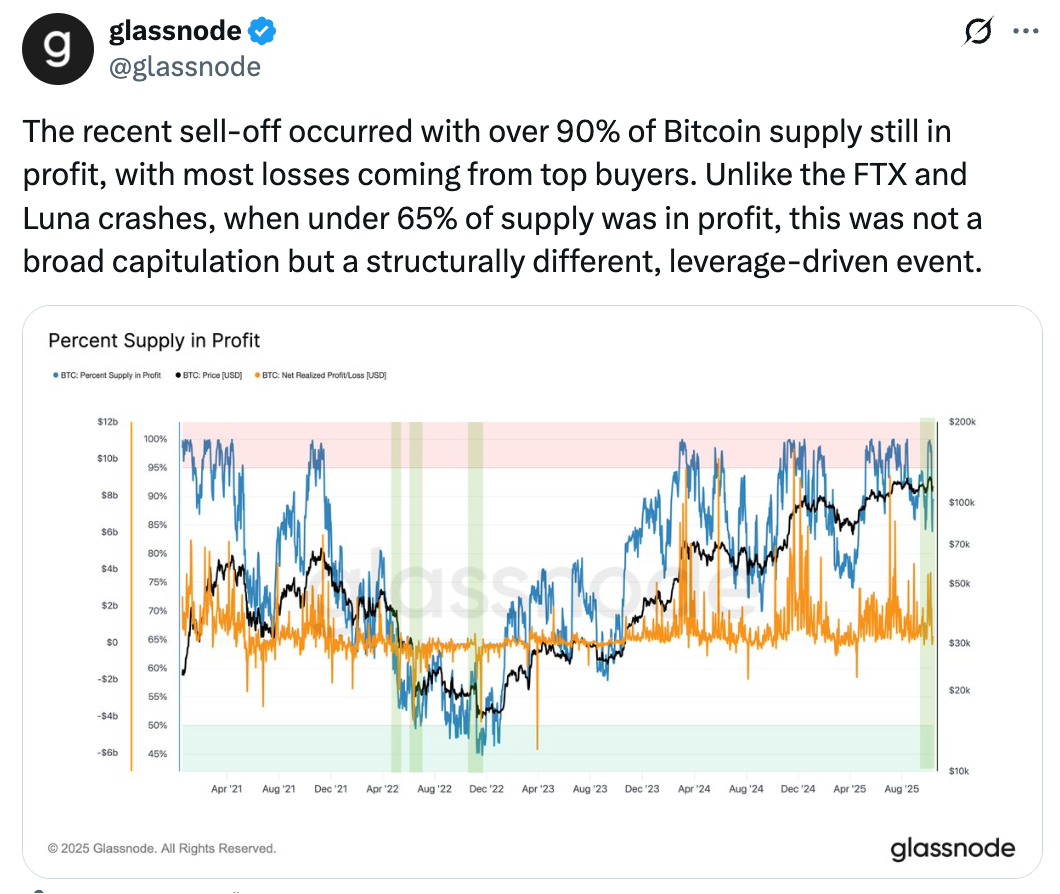

Glassnode analysis points out that during the recent wave of selling, over 90% of Bitcoin supply remained profitable, with most losses coming from top buyers. This is in stark contrast to the dire situation during the FTX and Luna collapses, when less than 65% of the supply was profitable. This indicates that this was not a large-scale panic sell-off driven by market capitulation, but rather a structurally unique, leverage-driven market fluctuation event.

Additionally, Glassnode states, "Bitcoin has stabilized above the 135-day moving average, and the Young Supply MVRV has fallen back to near 1.0." Considering these signs, the market is returning from a state of excessive speculation to rationality, while still retaining structural characteristics.

This analysis is confirmed by ETF data, as after experiencing a net outflow of over $760 million on October 13, U.S. Bitcoin and Ethereum spot ETFs quickly returned to net inflows on the 14th, with Bitcoin ETF and Ethereum ETF seeing net inflows of $103 million and $236 million, respectively, indicating that institutional investors remain optimistic about the long-term value of cryptocurrencies.

In the DAT market, there are also some noteworthy dynamics. According to monitoring data from BitcoinTreasuries, the total amount of Bitcoin held by listed companies is currently about 1,046,300 BTC. Among the top 100 listed companies, more than 10 companies have recently chosen to increase their Bitcoin holdings. Although this accumulation rate has slowed, new entrants to the market continue to emerge. For example, the listed company Zeta Network Group is raising $230 million through private placement to launch its Bitcoin treasury; UK-listed company Hamak Strategy has also successfully secured £35 million in funding, which will be used to support investments in assets such as gold and Bitcoin.

K33 Research Director Vetle Lunde has analyzed that after experiencing large-scale leverage liquidation, a constructive optimistic attitude should be held towards BTC, as the current market situation is conducive to gradually accumulating Bitcoin.

Notably, "heavyweight players" in the market have begun to become active again. According to monitoring by Yu Jin, after clearing out at an average price of $4,458 at the beginning of the month, "a whale/institution that made a profit of $93.74 million through ETH trading" has today re-entered the market by OTC buying 10,000 Ethereum at a purchase price of $3,987.

In a recent interview with CNBC, BlackRock CEO Larry Fink shared his views on long-term investment. He emphasized that whether in the crypto market or traditional stock market, the key is not to predict bubbles or short-term fluctuations, but to navigate through the entire bull and bear cycle while remaining in the market. It is evident that in this institution-led "bull market," institutional investors are clearly more patient, and they remain an important driving force in the current crypto market.

Turning to the stablecoin market, Tether has again issued 1 billion USDT on Ethereum today. Matrixport previously analyzed that although market volatility has intensified recently, stablecoin funds continue to flow in. Since the beginning of the year, Tether has issued approximately $42 billion, and Circle has issued about $32 billion, reflecting that this market still possesses strong resilience.

On the policy environment front, the openness of the U.S. regulatory policy environment continues to create a relatively stable soil for the development of the crypto market. On October 15, a new bill in the U.S. House of Representatives, the "Retirement Investment Options Act," will implement an executive order signed by President Trump, which clearly instructs the Department of Labor to clear obstacles and pave the way for including cryptocurrencies and private equity investments in 401(k) retirement plans.

On the same day, SEC Chairman Paul Atkins reiterated that cryptocurrency and tokenization are the SEC's "top priority." At a critical time when the SEC has listed the cryptocurrency industry as a priority regulatory target and is actively exploring regulatory pathways, innovation in this industry is bound to flourish.

However, compared to the relatively stable institutional forces and policy environment, the biggest uncertainty currently facing the crypto market is precisely the interest rate cut factor mentioned earlier.

In simple terms, a Federal Reserve interest rate cut will release market liquidity, reduce the opportunity cost of holding Bitcoin, and prompt some funds to shift from traditional financial assets to cryptocurrencies. Historical data shows that during multiple interest rate cut cycles by the Federal Reserve, Bitcoin prices have significantly risen due to liquidity easing and inflation expectations. A recent typical case is the Federal Reserve's reduction of the federal funds rate from 4.25% to 4.00% on September 18, marking the first rate cut of the year, and Bitcoin had already risen about 26% before the rate cut was implemented.

"The downside risks to employment have increased," said Federal Reserve Chairman Powell on Tuesday, indicating that the U.S. labor market shows further signs of distress, suggesting he may be prepared to support another rate cut later this month. This is the strongest hint since September, indicating that Federal Reserve officials believe they have enough evidence to support another 25 basis point reduction in U.S. borrowing costs.

Stephen Milan also pointed out that the high uncertainty of trade policy has brought "new tail risks." According to the median forecast of 19 Federal Reserve policymakers, there will be two more 25 basis point rate cuts in 2025. Goldman Sachs boldly predicts in a report that to stimulate the U.S. economy, the Federal Reserve is expected to cut rates by 25 basis points in both October and December, further intensifying market speculation about future interest rate changes.

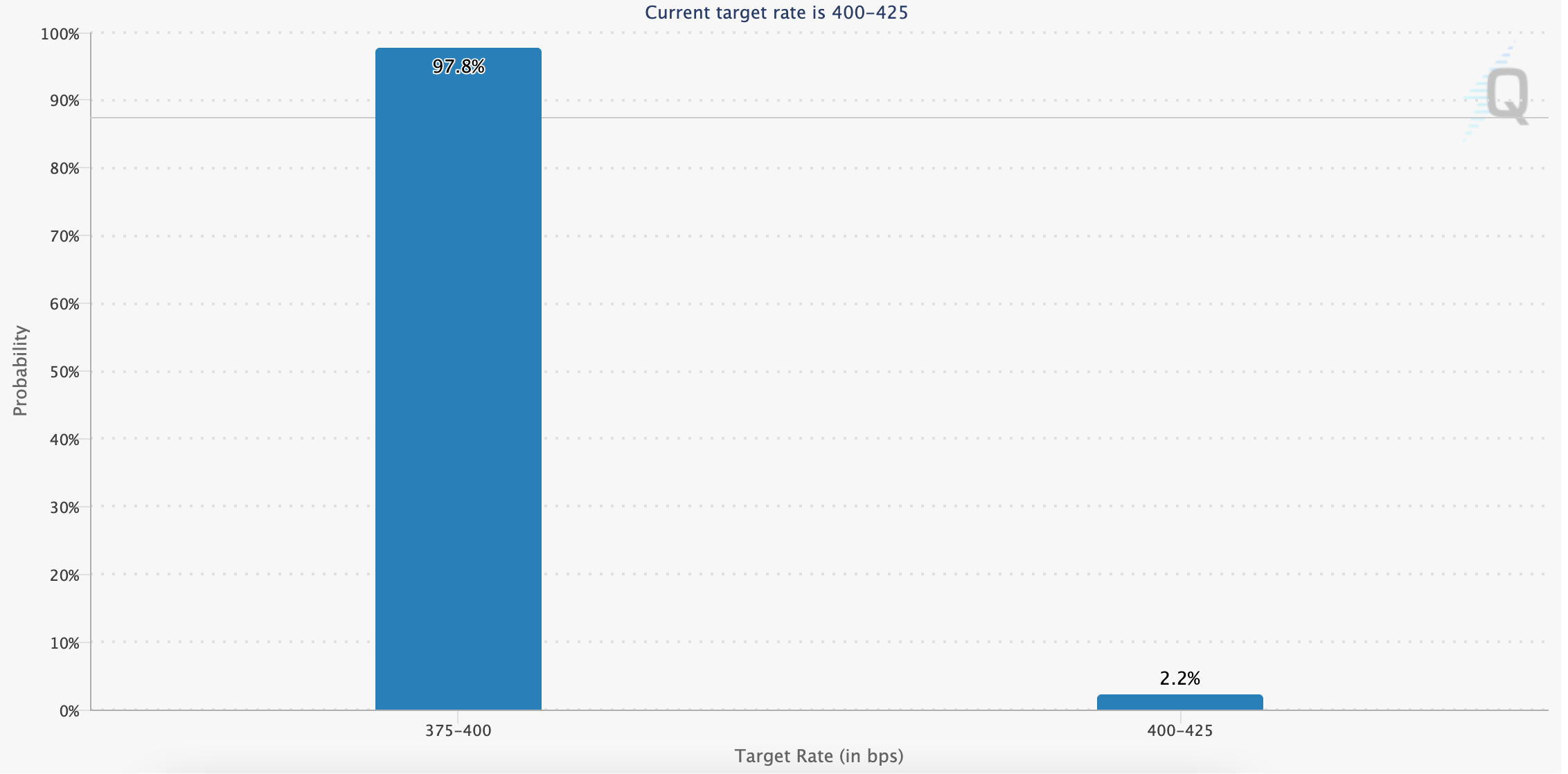

According to CME's "FedWatch," the probability of a 25 basis point rate cut by the Federal Reserve in October has reached as high as 97.8%, and a rate cut seems to be a foregone conclusion. However, it is worth noting that the crypto market has always exhibited characteristics of "buying the expectation" and "selling the fact." In fact, the Federal Reserve had already hinted at the possibility of two more rate cuts before the end of the year when it cut rates in September, and this information may have already been preemptively digested by the crypto market. Moreover, historical data indicates that the liquidity transmission from rate cuts to the crypto market typically takes 3 to 6 months. This means that rate cuts may not be an immediate "shot in the arm" for the crypto market, but rather have a more profound and lasting impact.

Summary

Currently, the overall crypto market presents a complex pattern of "longs and shorts intertwined," in a critical game stage of "policy expectation repair" and "liquidity reconstruction."

At this stage, the expectation of interest rate cuts has to some extent driven the repair of risk assets and prompted some institutions and retail investors to accumulate Bitcoin on dips, but most institutional and retail investors are still on the sidelines. On the other hand, after the clearing of leveraged funds, market liquidity has not been effectively restored, and the market capitalization share of altcoins continues to decline, posing certain challenges to the market ecosystem. In the short term, the market lacks new demand injections, so before the market restores balance, there is a high likelihood of periodic adjustments or localized "capitulation" sell-off events. However, as mentioned earlier, this market crash was not driven by widespread spot selling; it was more of a structural reset of the market rather than a comprehensive "capitulation crisis."

On a positive note, as the saying goes, "no destruction, no construction." Although this market crash has brought short-term pain, it has effectively cleared out the bubbles formed by excessive leverage and speculative capital, reducing the systemic risk of the market and creating favorable conditions for building a more stable bull market structure.

Additionally, after in-depth analysis of the "10.11" crash event, Bitwise's Chief Investment Officer pointed out that the "bull market" in the crypto market will continue, as the fundamental factors such as underlying technology, security, and regulatory environment have not changed. However, we must be clear that the chain reaction triggered by this crash has not yet ended.

As of the time of writing, Bitcoin has once again fallen below the $110,000 mark, and Ethereum has also dropped below $4,000, with almost all areas of the crypto market experiencing declines. This indicates that despite the presence of favorable factors such as interest rate cut expectations, the market is also facing severe risks of deep corrections, and there is an urgent need for new catalysts to reverse the current downturn.

Finally, it is worth mentioning that on October 13, Trump posted on Truth Social, stating, "Don't worry about China, everything will be fine. America wants to help China, not hurt China." This statement seems to suggest that he may cancel the new tariffs on China. In fact, the additional tariffs may just be a common tactic used by Trump in political maneuvering, serving as leverage in negotiations with China. In other words, whether this tariff policy will ultimately be implemented remains uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。