Today's homework is more challenging. After the U.S. stock market opened in the evening, the price of $BTC has been on a downward trend, while the performance of the U.S. stock market itself is still quite good. Even with the Federal Reserve announcing a 25 basis point rate cut and preparing to stop tapering in December, it did not halt Bitcoin's decline. I checked some data and information and found no negative content. My first thought is that the U.S. stock market, especially tech stocks, is absorbing more liquidity.

The second viewpoint is that the market has sufficient expectations for a rate cut in October, and this part of the increase has already been reflected in advance. Therefore, not only cryptocurrencies are experiencing a pullback, but most of the U.S. stocks are also seeing a correction, and the impact of stopping tapering in December on the market is not significant. In other words, this resembles a "Sell the News" scenario, where the market has completed its phase of predictions.

Next is the estimate for a rate cut in December, which is the main reason for the overall market decline. The market had previously anticipated another rate cut in December, but Powell's remarks significantly reduced this probability, especially since Powell spoke quite decisively, stating that unless there is a substantial increase in unemployment data, the likelihood of a rate cut in December is low.

Although there are some internal disagreements within the Federal Reserve, the information mainly reflects the "opposition" between Mylan and Schmidt. From this, we can see that although some Federal Reserve officials are leaning towards Trump, they are not very aggressive when it comes to actually deciding on interest rates. The only one truly conveying Trump's message is Mylan, which should also be a headache for Trump.

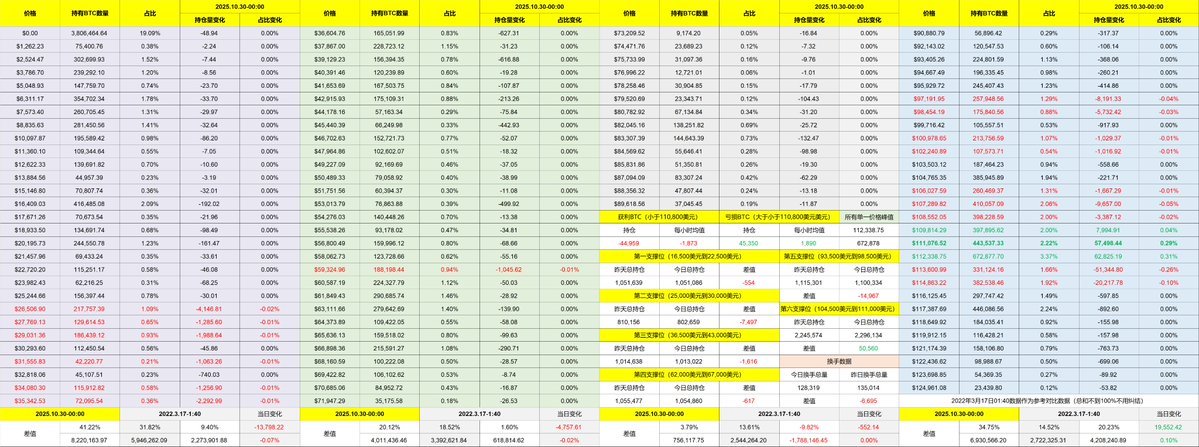

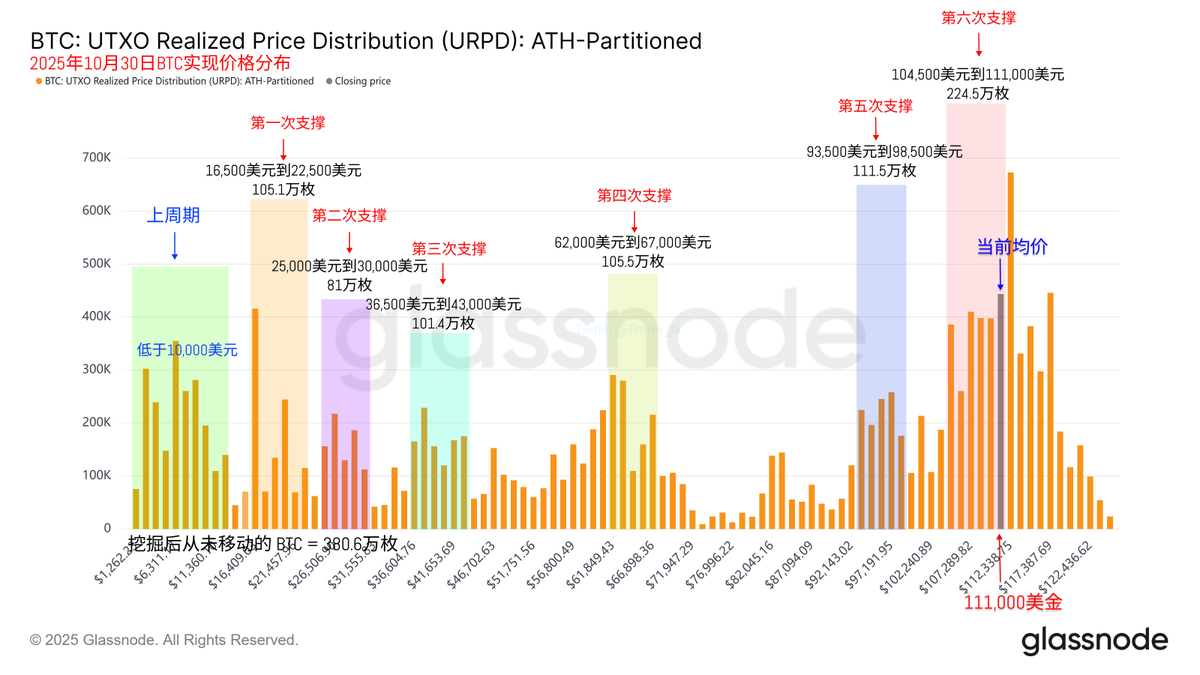

Looking back at Bitcoin's data, although the price has further declined, the turnover rate has not continued to increase, indicating that market sentiment has not worsened. Only some short-term investors are mainly participating in the turnover, while earlier investors have not reacted significantly.

By the close, although the U.S. stock market experienced some pullback, it did not affect the trend's change. The market is now more eager for the earnings reports of major tech stocks. If the earnings reports are favorable, it could lead to a market rebound, and even $BTC has a chance to continue rising. Currently, the support structure and stability of BTC have not shown any issues.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。