1. Why is the Privacy Track Launching in 2025?

1.1 The Tension Between Regulation and On-Chain Structure Becomes Apparent

The crypto ecosystem from 2024 to 2025 shows a clear structural fracture. On one hand, ETFs and institutional funds have become the dominant source of liquidity for BTC/ETH, accelerating the concentration of market pricing power towards compliant funds; on the other hand, the "narrative space" that the native crypto community relies on is continuously shrinking, and the core values of crypto culture are being eroded by institutional frameworks.

As the regulatory system deepens, the industry gradually enters a stage of "over-compliance." Key technological directions such as ZK, privacy, account abstraction, and social recovery are required to actively adapt to regulatory frameworks, making the friction between the native community and compliance logic increasingly evident. In 2025, several core community members, including Vitalik, repeatedly emphasized the importance of privacy, summarizing their core viewpoint as: Cryptocurrencies lacking privacy protection will degrade into mere financial tools, no longer belonging to the Cypherpunk movement.

This tension at the value level has made "privacy" a highly sensitive topic in the crypto ecosystem once again.

1.2 Regulatory Attitudes Show Marginal Shift: From "Comprehensive Crackdown" to "Selective Ignorance"

Compared to 2020-2023, there has been a mild structural change in global regulatory attitudes towards privacy tools in 2024-2025:

- United States: Privacy Discussions Return to Technical Realm

With the change of government in the U.S., the regulatory narrative around protocols like Tornado Cash has noticeably cooled, and privacy issues are gradually returning from "political risk" to "technical discussion." Although there has been no substantial relaxation in regulation, the decrease in enforcement frequency and regulatory intensity has created a larger space for discussing privacy narratives.

- European Union: Policies Become More Moderate, Focus Shifts to VASP Compliance

In the new discussions of MiCA 2.0, technical requirements such as privacy addresses have weakened, with greater emphasis on the KYC/AML responsibilities of VASPs rather than directly denying the assets themselves. The focus of the policy framework has shifted from "prohibition" to "management," leaving an operational compliance buffer for privacy assets.

- Asia: Regulatory Focus Returns to CEX and AML Processes

Discussions around on-chain privacy in the Asian market have significantly decreased, with more attention on the AML processes and fund review logic of CEXs. The risk labels associated with on-chain privacy technology are weakening.

1.3 The Narrative Space for the Privacy Track Reopens

Under the aforementioned marginal regulatory changes, the privacy track is gradually shifting from a "policy-sensitive area" to a "field where technical discussions can be reopened." This shift from comprehensive suppression → selective ignorance has opened up critical narrative space for privacy assets:

- It is no longer a primary target of regulatory crackdowns.

- It still possesses anti-censorship value, which gives it a natural foundational base within the native community.

- The moderation of the regulatory framework provides a minimum tolerance level for narrative recovery.

Historically, each market rally in the privacy track has stemmed from the synergy of "technological breakthroughs + marginal regulatory improvements + changes in market structure." The context of 2025 happens to meet this combination once again.

2. Liquidity Structure and Fund Behavior: The Privacy Track Becomes a New "Narrative Carrier"

2.1 Liquidity Concentration: Traditional Rotation Paths Are Hard to Continue

A core feature of the current market is:

Mainstream liquidity is highly concentrated, significantly compressing the rotation space for on-chain native funds.

This includes the following aspects:

- No large-scale interest rate cuts or easing have occurred at the macro level, resulting in limited new funds entering the crypto market.

- ETFs and staking have locked up a large amount of BTC/ETH liquidity, reducing the tradable supply of mainstream assets.

- High-frequency speculative directions such as Meme, AI-meme, BRC, and ICO have siphoned off a large amount of on-chain speculative capital, creating pressure on other tracks.

This structure leads to two outcomes:

- Mainstream rotation models are difficult to replicate from the previous cycle.

The traditional path of L1 → L2 → DeFi → GameFi → Public Chain is hard to reproduce in this cycle, as the over-concentration of funds limits the diffusion effect on-chain.

- The native crypto community lacks new "narrative carriers."

- BTC is fully institutionalized.

- Stablecoins are strictly regulated.

- L2 competition is fierce, making it hard to see a hundredfold coin space.

This necessitates a new direction to accommodate the liquidity and emotional needs of the native community.

2.2 The Privacy Track Has Four Key Advantages in This Context

In the context of high liquidity concentration and a lack of narrative space, the privacy track precisely meets the real needs of native funds. It possesses four core conditions that make it "naturally fill a blank space":

(1) Low Market Cap, High Price Elasticity

Mainstream privacy projects have been sluggish for a long time, resulting in a low valuation base that makes it easier to form structural pushes and trend rallies.

(2) Solid Underlying Technology with Extensible Narratives

ZK technology, privacy payments, unified addresses, and composable privacy are all mature directions with a solid engineering and narrative foundation for repeated expansion.

(3) Embodies Cypherpunk Spirit Attributes

Privacy is an important component of the native value of crypto, easily gaining community recognition and having a long-term narrative accumulation.

(4) Matches the "Marginal Moderation" of Regulatory Trends

Regulation has shifted from being a "strong regulatory target" to "not a priority for enforcement," reducing the market's risk discount for this track.

Therefore, the privacy track has structural conditions to become a focal point of fund attention in 2025, not merely a rebound, but rather a structural vacancy being filled.

2.3 The Rise of Privacy Assets in Q3-Q4 2025 Exhibits "Proactive Structural Push" Characteristics

Observing recent market behavior, the rise of privacy assets in this round is not a natural diffusion but shows clear signs of proactive push:

- Some OG funds and Asian trading teams have positioned themselves in advance, increasing concentration of holdings.

- The frequency of social interactions between funders, contract markets, and ZEC/ZK development teams has increased, expanding market attention.

- ETH whales have repeatedly absorbed ZEC/DASH at low levels, indicating strategic accumulation characteristics.

These signs indicate:

This round of privacy market activity resembles a result of "structural push + careful ignition," rather than being driven by natural market sentiment.

The revival of narratives and fund behavior is consistent in both time and structure.

3. The Integration of AI, Payments, and Crypto at Scale Provides More Space

As AI, on-chain payments, and data sovereignty become mainstream application directions in 2025, the demand related to privacy shows a structural upward trend. Privacy coins are not the only solution in this system, but they are the most directly tradable and easiest to be priced by the market. Therefore, these emerging narratives provide external increments for traditional privacy assets, allowing them to gain significant "narrative linkage rights" in this cycle.

In 2025, the deep integration of AI and crypto is forming several key trends:

- On-chain Banks

Emphasizing the controllability of account systems, transaction paths, and user privacy.

- Data Sovereignty

Users need to manage the visibility, transferability, and verifiability of their own data autonomously.

- Reconstruction of PayFi and Crypto Payment Systems

In the processes of cross-border payments, on-chain settlements, and stablecoin promotions, the dual demand for "auditable + private" is increasing.

- AI Agents and Automated Trading Execution

When AI agents initiate on-chain actions on behalf of users, the risk of privacy leakage becomes a core issue.

- Increased Demand for User-Level Privacy Computing

There is a need to ensure that user transactions, identities, and asset distributions on-chain cannot be easily associated.

These trends collectively point to a core fact:

When AI, payments, and on-chain identities enter a large-scale implementation phase, privacy protection is no longer optional but a fundamental necessity.

Thus, in this round of privacy market activity, the market is more inclined to trade: "mainstream privacy assets that are implementable + composable + with clear engineering progress," rather than pricing future technologies in advance.

4. The Engineering Progress of Mainstream Privacy Coins: The True Driving Force Behind This Round of Market Activity

The core of this round of privacy market activity is not the technical directions like FHE that are still in the conceptual stage, but rather the long-term breakthroughs in engineering capabilities, wallet experiences, protocol structures, and ecological governance of mainstream privacy coins being revalued by the market.

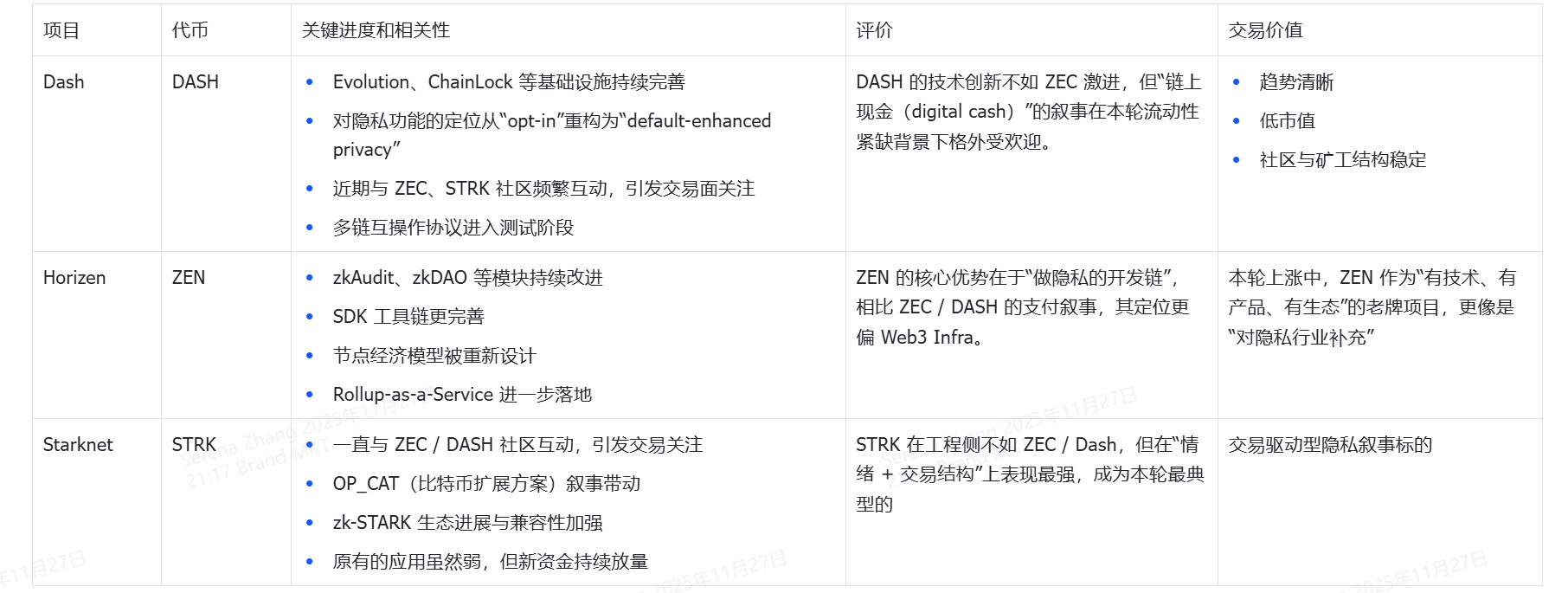

Projects like ZEC, DASH, ZEN, and STRK constitute some of the most representative assets in the privacy track, with their technological evolution, ecological positioning, and trading structures forming the underlying driving force of this round of market activity.

4.1 ZEC (Zcash) Technical Foundation and Ecological Economy's Dual Flywheel

- NU5 Upgrade: A Key Breakthrough from "Academic Privacy" to "Engineering Privacy"

Core upgrades such as Halo 2, Orchard, and UDT continue to advance, with NU5 (Orchard + Halo2 + Unified Addresses) pushing Zcash from "academic-level privacy technology" to a more usable and composable engineering stage. The proof system Halo2 removes trusted setup, Orchard enhances the shielded transaction experience, and Unified Address simplifies the wallet receiving process. Together, these significantly lower the usage threshold while creating a clearer imaginative space for future compliance integration and L2/Rollup access.

- Orchard does not rely on trusted setup. Under the promotion of the Electric Coin Company engineering team (including Sean Bowe), it has become one of the most advanced, secure, and verifiable zero-knowledge payment systems currently available.

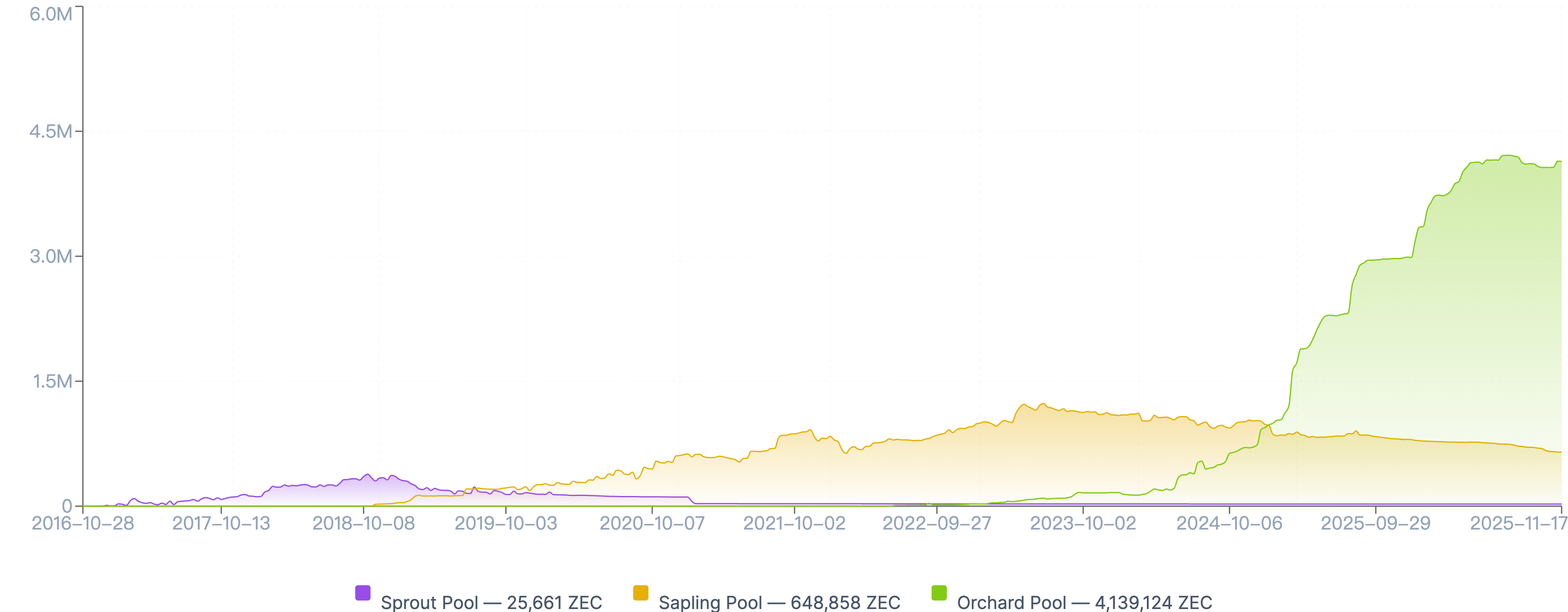

- Unified Address integrates Orchard, Sapling, and Transparent addresses into a single receiving format, which is expected to significantly increase the proportion of funds entering the shielded pool. Currently, external observers cannot distinguish whether funds are entering the transparent pool or the shielded pool.

- The Orchard pool serves as a significant enhancement to the existing shielded pool, forming an independent anonymous environment alongside the Sapling and Sprout pools.

- Transactions in Orchard reduce metadata exposure and enhance anonymity through Orchard's "action" mechanism, a feature not present in traditional UTXO models.

- NU6 Upgrade: Transitioning from Technical Orientation to Ecological Governance and Sustainable Economic Models

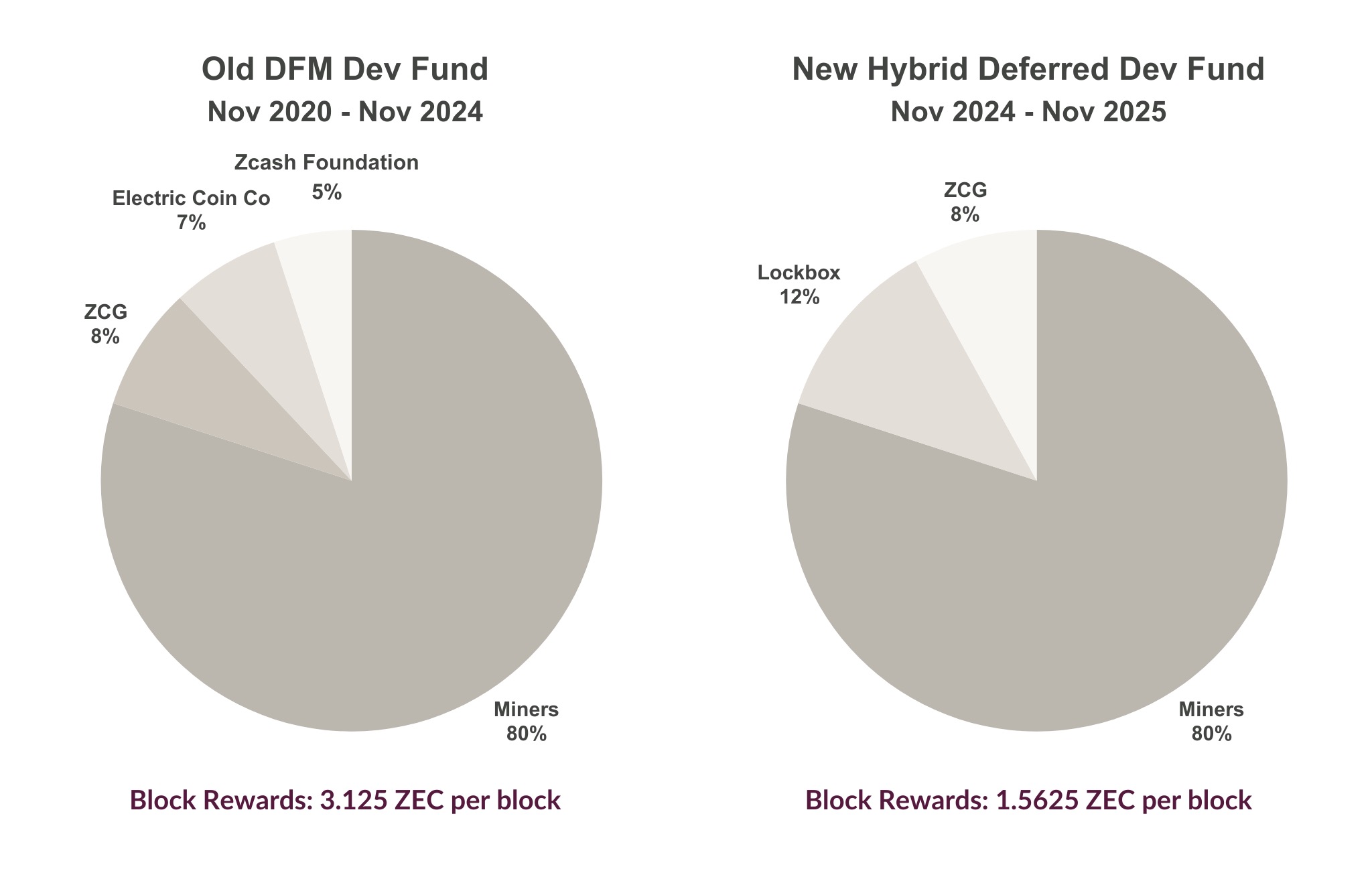

One of the key initiatives of NU6 is the introduction of a new Zcash development fund model. The new "non-direct funding model" replaces the old model (which allocated 20% of block subsidies to fund the Zcash community, Electric Coin Company, and the Zcash Foundation).

The new Lockbox mechanism, based on community feedback and proposed in ZIP 1015, will accumulate 12% of block subsidies into a lockbox account. Funds will be used for ecological construction only after the community reaches a consensus on the disbursement mechanism, ensuring that key development projects have stable support in the long term.

At the same time, Zcash community funding will continue to receive 8% of annual funds for project funding.

- Long-term Narrative Direction: Expanding Application Scenarios and Scalability Become the Next Challenges

The integration of ZK-Rollup / L2 is seen as a key potential direction for Zcash. However, it faces dual challenges of engineering complexity and economic model structure. If achieved, it is expected to make Zcash's shielded pool a scalable, DeFi-compatible privacy execution layer. The community has already begun preliminary explorations and proposals, but implementation will still take time.

Notably, the ecological developer Dimahledba has proposed the "Ztarknet" solution, which attempts to combine Starknet and Zcash to build a dual-layer network that is both private and scalable, allowing network fees to be paid with ZEC. This proposal has received early support from several community members, including founder Zooko Wilcox.

Overall, the NU6 series covers ecological governance, funding models, development fund management, and long-term sustainability mechanisms (including the coinholder-controlled fund and grant models proposed in NU6.1), while also addressing performance optimization and technical debt clearance. NU5 lays the technical foundation, while NU6 supplements and strengthens ecological governance and economic structure.

After solidifying the technical foundation (NU5), the future ecological and funding models (NU6) will determine how development resources are allocated, how governance balances community and institutions, and whether the development pace can remain stable, directly impacting the long-term market confidence in ZEC. The positioning of ZEC and the Zcash network has shifted from "the hype narrative of a BTC privacy fork" to "a privacy infrastructure with continuous R&D and governance capabilities."

4.2 The Relevance of Other Mainstream Privacy Coins and Tracks

- Reasons Why Related Concepts Like ZK / FHE Did Not Experience a Rally

Privacy-related ZK and FHE concept projects did not show linkage in this round, mainly due to:

- Unverified commercial scenarios, lacking a sustainable demand loop.

- Insufficient engineering implementation, still in the early R&D stage.

- Lack of long-term narrative accumulation and recognition from mainstream funds.

Therefore, the nature of this round of market activity remains:

A revaluation of traditional privacy coins, rather than speculative hype for ZK or FHE in advance.

5. Does This Round of Privacy Market Activity Have Sustainability?

The relaunch of the privacy track in 2025 is not coincidental, but rather a result of the interplay of four factors: the marginal weakening of regulatory attitudes, the contraction of mainstream altcoin liquidity, the accumulation of native narrative demand, and the long-awaited progress on the engineering side, forming a "convergence market" and "structural funding demand." However, the core uncertainty regarding its sustainability lies in: Can privacy assets truly assume foundational functional roles in directions like PayFi, AI Agents, and On-chain Banks?

If these roles can be assumed, the privacy track may grow into a "value anchoring sector" for the new cycle; if not, this round of market activity may enter a differentiation phase in 1-2 quarters.

The rise of the privacy track in 2025 is not merely a rebound or driven by sentiment, but a structural result following the crypto industry's entry into the institutional era. BTC has been redefined as "digital gold," ETH has become the L2 capital market, and privacy has once again become the core value outlet of Web3.

The essence of this round of market activity is a revaluation of privacy value; a phased return to the Cypherpunk spirit; a reflection of the imbalance in mainstream funding structures; and a delayed realization of engineering breakthroughs. The truly pressing question is not "Why did privacy rise?" but rather: In the context of parallel developments in AI and institutionalization, will privacy once again become the main value of crypto assets? Does the privacy track have the opportunity to welcome a structural long-term trend? All of this awaits further validation from the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。