Author: Gu Yu, ChainCatcher

Today, Kyle Samani, co-founder and managing partner of Multicoin Capital, announced on his social media account that he will step back from the daily management and investment decisions of Multicoin Capital and will explore opportunities in other technology fields outside the crypto industry. Multicoin's official statement later confirmed that the fund will continue to operate normally, and the existing investments and team structure will not be affected.

“Best Crypto Investor” Chooses to Fade Out

This is undoubtedly a significant piece of news in the crypto VC circle. For a long time, Kyle Samani has frequently written long articles, participated in industry debates, maintained a distinct stance on investment strategies, and, thanks to his early investment in Solana that yielded hundreds of times returns, he has not only been the soul of Multicoin Capital but also one of the most influential investors in the crypto industry.

Previously, Dragonfly managing partner Haseeb Qureshi wrote about his three favorite crypto investors, ranking Dan Robinson, Chris Dixon, and Kyle Samani as third, second, and first, respectively.

“Kyle is one of the few true contrarian investors in the cryptocurrency space. I disagree with almost all of his views. But his initial investment, and his steadfast belief in holding Solana through the downturn after the FTX collapse, undoubtedly makes him one of the greatest venture capitalists in the history of cryptocurrency,” Haseeb Qureshi wrote.

And it is this “historical best” who chose to announce his resignation at one of the bleakest moments in the crypto industry, which inevitably raises questions: even the top VC investors can no longer persist? After all, just a few years ago, even when the price of SOL was affected by the FTX incident and fell below $10, he still maintained his investment viewpoint and ultimately proved himself with a more than 25-fold increase.

Shortly after the announcement, a tweet that Kyle Samani posted earlier today on his X account and quickly deleted was also uncovered.

According to the information, Kyle Samani responded to a complaint from X user Taran (@Taran_ss) by stating: “Cryptocurrency is not as interesting as many people (including myself) once imagined. I used to believe in the vision of Web3 and dApps. Now I don’t. Blockchain is essentially an asset ledger. They will reshape finance, but that’s about it, nothing more. DePIN is another noteworthy area. Cryptocurrency will continue to improve, but all the truly interesting questions have been answered, except for the issue of on-chain privacy/confidentiality. (I still firmly believe Zama will win this race.)”

In this response, Kyle Samani clearly expressed that he no longer finds crypto interesting and no longer believes in the vision of Web3. Apart from reshaping finance, it is difficult for blockchain to play a larger role in other areas. Privacy and DePIN are the only fields he still recognizes.

Multicoin Capital also further validated the notion of “Kyle’s disinterest in crypto” in a letter to LPs, stating that “Kyle’s interests have expanded from cryptocurrency to other technology fields such as artificial intelligence, life sciences, and robotics, and he has decided to invest time exploring these emerging technologies.”

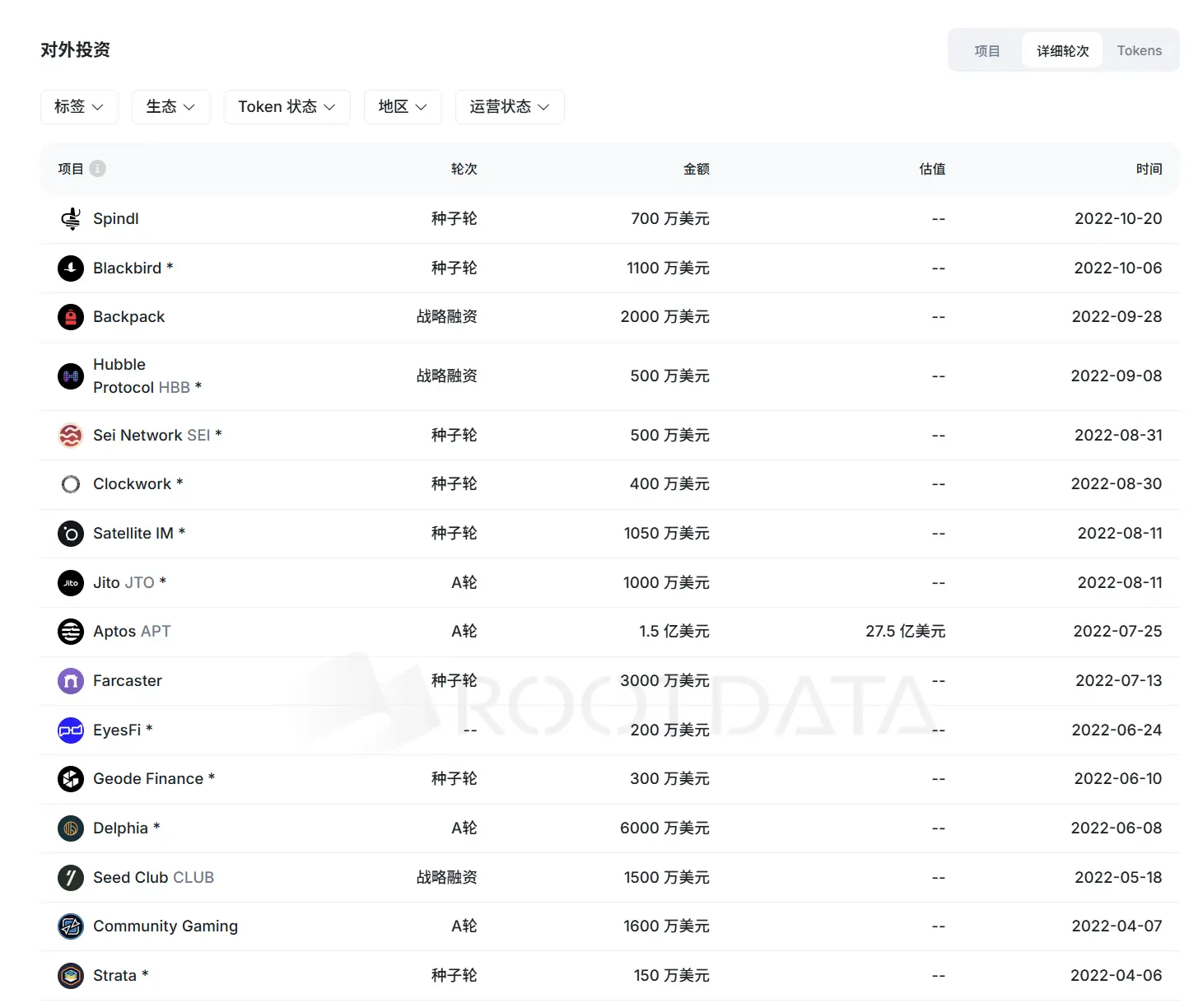

Data also reflects that Multicoin Capital's attitude and strategy are undergoing significant changes. According to RootData, since the second half of 2025, Multicoin Capital has participated in only 4 investment rounds, and since October 2024, only 10 times, which not only represents a significant slowdown in investment frequency but also clearly lags behind other well-known VCs during the same period, ranking below 50.

History of Multicoin Capital's Investment Rounds Source: RootData

These changes are partly due to the dismal market conditions and performance. Among the projects that Multicoin Capital heavily invested in over the past few years, the Wormhole token, which was valued at $2.5 billion (with a total financing amount of $225 million, second only to the investment rounds of Forward Industries, FTX, and Solana), now has an FDV of only $220 million, the Pyth Network token has an FDV of only $480 million, and Solana's market cap has once again fallen below $100.

At this point, the reasons for Kyle Samani's departure have become very clear: he believes that the direction of crypto development has deviated from his expectations and even his values, and the disillusionment has forced him to decide to leave this place of sorrow and attempt to regain his passion in fields like AI and life sciences.

Moving forward, Multicoin Capital will also have to face the situation after “losing its soul.” Kyle Samani's exit will undoubtedly raise questions about its future direction and leadership: with a sharp slowdown in investment and organizational restructuring, will Multicoin Capital still be one of the most research-oriented and steadfast VCs in the industry?

The Low Point of Idealism

In fact, before Kyle Samani, many crypto investors and entrepreneurs had already expressed similar views, resigning and choosing to temporarily leave the crypto industry. In January, a16z Crypto general partner Arianna Simpson announced her departure and plans to establish a new fund that invests across various industries, not limited to crypto.

A more notable case is Ken Chan, former co-founder and CTO of Aevo. In an article published in November 2025, he bluntly stated that he wasted eight years of his life on cryptocurrency and described the crypto industry as “the largest and most participatory super casino in the world.”

“After eight years of struggling in the cryptocurrency field, I have completely destroyed my ability to discern sustainable business models. In the cryptocurrency space, you can make money without a successful business or product. The crypto industry is filled with a large number of tokens with extremely high market values but almost no interest,” Ken Chan believes. “This industry mentality is extremely harmful, and I believe it will lead to a long-term collapse of social mobility for the younger generation.”

A series of emerging cases are outlining a clearer trend: against the backdrop of a persistently tight macro environment, as the wealth effect of the crypto market significantly weakens, typical products face long-term obstacles to scaling, and the core narratives that once supported industry expansion are being debunked one by one, the crypto industry is experiencing a phase of losing some of its earliest and most idealistic builders and investors.

This loss does not mean a fundamental denial of crypto technology, but rather reflects that the patience driven by idealism is being tested by the continuously prolonged realization cycle. Before the return structure, industry order, and long-term expectations are reestablished, some core participants choose to exit temporarily.

In past cycles, many VC investors have emphasized that high-return investments often occur when the market is “ignored,” and bear markets are the best time to capture investment alpha. However, now even the “historical best investor” is choosing to turn away at this moment, which itself conveys a signal that the industry should take seriously: the problem may no longer be just a cyclical market pullback, but rather a phase bottleneck in the crypto industry regarding innovation capability, value orientation, and narrative vision, which may be undergoing unprecedented scrutiny and reevaluation.

Fortunately, more first-line VCs such as Coinbase Ventures, a16z, YZi Labs, and Pantera Capital remain active, with over 30 investments in the past year. For the crypto industry, which is in a period of adjustment, the support of these VCs may not immediately bring new prosperity, but at least it means that this round of reevaluation has not evolved into a complete exit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。