Author: Nancy, PANews

The battle for stablecoin infrastructure has already begun this hot summer. Currently, giants like Tether, Circle, and Stripe are entering the arena to develop their own blockchains, attempting to upgrade from mere on-chain payment tools to enterprise-level financial infrastructure. In this new landscape, payment experience, liquidity, and compliance advantages will become key bargaining chips for all parties involved.

Circle to Launch L1 with Optional Privacy Features

On August 12, Circle released its first post-IPO earnings report. Despite a net loss exceeding $480 million due to non-cash expenses related to the IPO, Circle demonstrated robust growth with a 53% year-on-year revenue increase and a staggering 90% annual circulation increase for USDC, aided by compliance advantages and ecosystem subsidy strategies.

With the official rollout of the U.S. stablecoin bill GENIUS, the development of stablecoins has reached a historic turning point, significantly expanding growth opportunities. As more traditional financial institutions enter the market, competition is further intensifying. Consequently, Circle is focusing on stablecoin payment infrastructure, aiming to diversify its revenue channels.

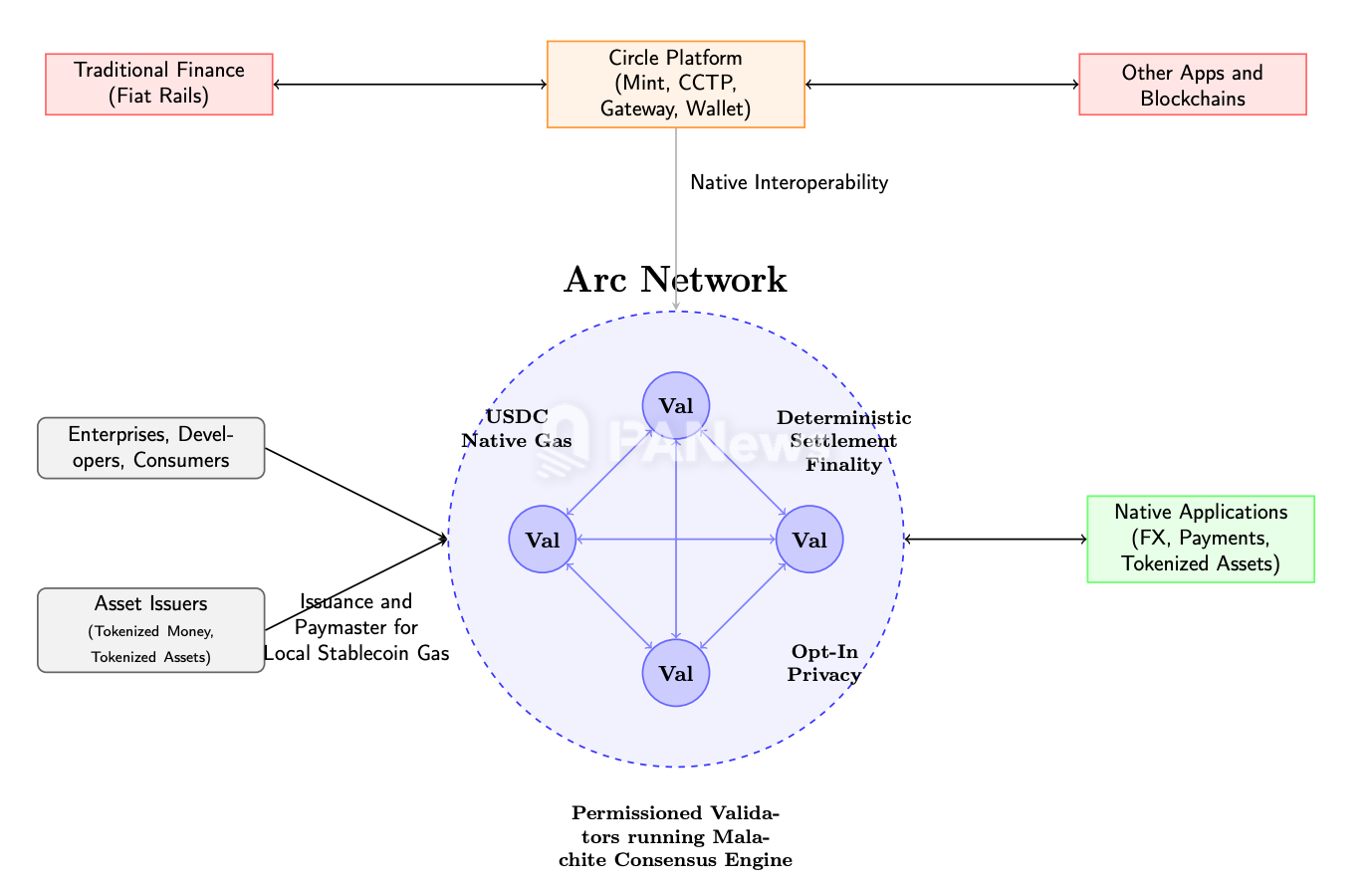

On earnings night, Circle announced the upcoming launch of Arc, an open Layer 1 blockchain specifically designed for stablecoin-native applications. The goal is to create a blockchain platform that balances efficiency, compliance, and developer-friendliness to meet the stringent demands of enterprise-level finance.

“Arc is a pivotal moment in our construction of a full-stack internet financial system. It combines the stability of stablecoins with the openness of blockchain, providing a trusted and efficient platform for enterprises, developers, and financial institutions, helping the global economy enter the era of programmable money,” said Circle CEO Jeremy Allaire.

Arc is positioned as the operating system for global financial innovation, supporting core applications such as cross-border payments, on-chain credit, and capital market settlements. It also provides secure, automated on-chain trading capabilities for machines, systems, and AI agents, supporting complex financial scenarios like real-time capital management, supply chain finance, and automated treasury operations.

According to official information, Arc is built on the high-performance consensus engine Malachite developed by Informal Systems, with 4 to 20 regulated, geographically distributed well-known institutions serving as validators. It achieves sub-second transaction finality, with final confirmation times below 100-350 milliseconds, greatly enhancing transaction speed and efficiency to meet the needs of high-value financial scenarios (such as cross-border payments and capital market settlements). As an EVM-compatible blockchain, Arc allows developers to quickly leverage existing ecosystems and tools to build and deploy a variety of stablecoin financial products. Thus, in terms of consensus design, Arc resembles a familiar consortium chain architecture in China, where nodes with access thresholds are undoubtedly favored by regulators.

Arc uses USDC as its native gas and employs a dynamic fee market similar to Ethereum's EIP-1559, providing low and predictable dollar-denominated fees, addressing the pain point of enterprises being reluctant to hold volatile crypto assets to pay gas fees. In addition to USDC, Arc also plans to support EURC, tokenized short-term treasury fund USYC, or tokenized currency to pay gas fees through Paymaster, lowering the usage threshold in a multi-currency market. Furthermore, Arc features an institutional-grade RFQ quoting system for foreign exchange, enabling instant, 24/7 settlement and price discovery between stablecoins. Additionally, Arc offers optional privacy protection to help enterprises comply with sensitive data handling (amounts hidden, addresses visible), meeting regulatory and compliance needs, and deeply integrates Circle's full range of products to build a stablecoin financial hub.

Arc's private testnet is expected to launch in the coming weeks, with a public testnet planned for this fall, and the mainnet Beta is anticipated to officially launch in 2026.

Multiple Institutions Compete, Stablecoin-Specific Chains May Become a Trend

In the stablecoin space, Circle is not the first issuer to attempt building its own chain.

“Some companies' strategies look just like moths to a flame.” Following Circle's announcement of the L1 launch, Tether CEO Paolo Ardoino's somewhat provocative comment was interpreted in the industry as a jab at competitors.

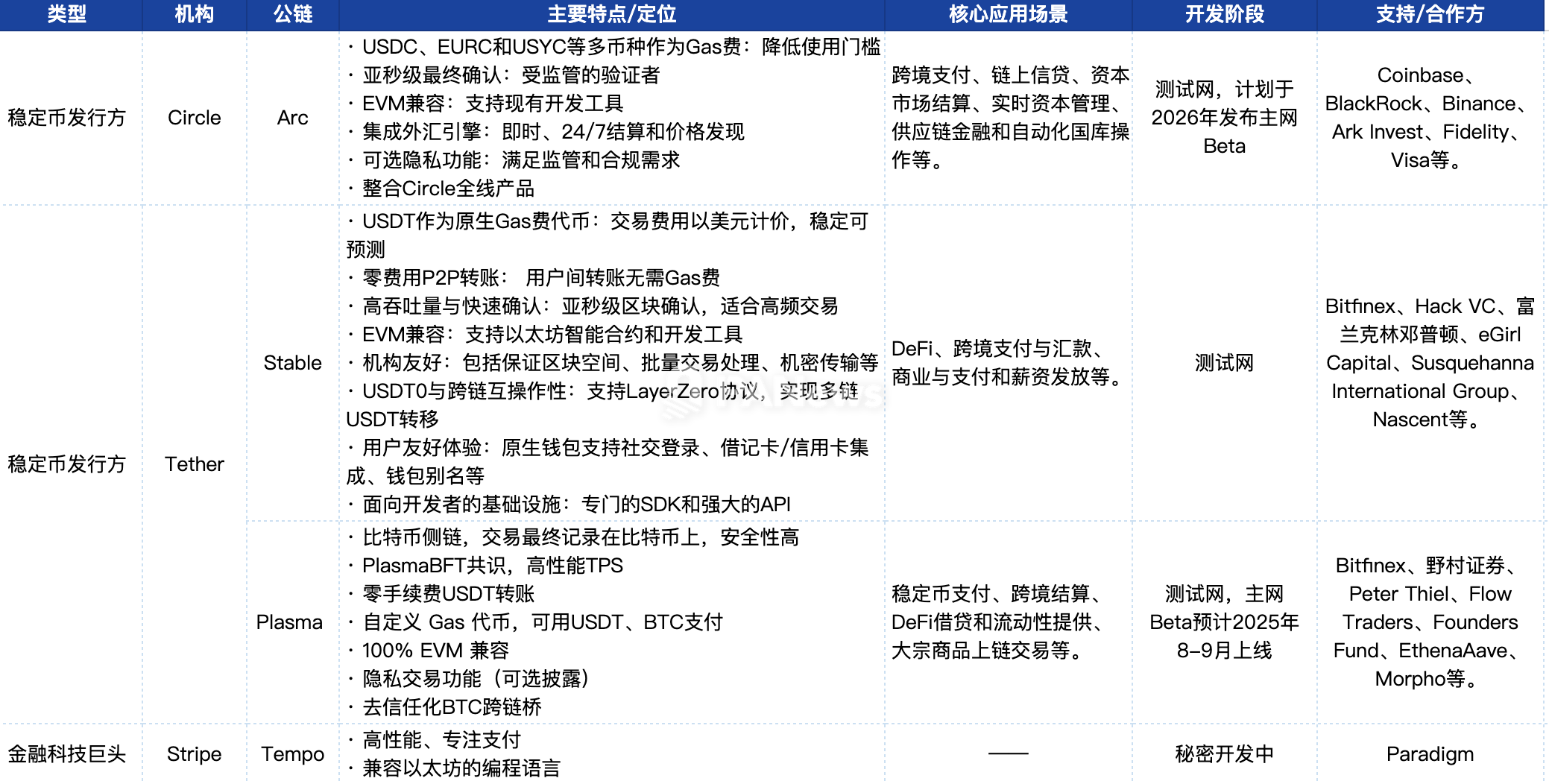

As the world's largest stablecoin issuer, Tether has already taken the lead, launching two blockchains specifically optimized for stablecoins, Plasma and Stable, aimed at accelerating the global payment and settlement applications of USDT through zero-fee transactions, high throughput, and dedicated stablecoin infrastructure.

Stable's positioning is similar to Circle's Arc, both targeting institutional users with EVM-compatible stablecoin-specific L1 chains, both hoping to replace general-purpose public chains in cross-border payment, settlement, and compliance scenarios. However, there are significant differences in fee structures, target markets, compliance, transparency, and technical architecture.

For instance, in terms of fees and gas mechanisms, Stable uses USDT as its native gas token, with zero fees for P2P transfers and supporting dollar-denominated smart contracts. This design caters to retail users (no pressure for small transfers) while also facilitating institutions in handling cross-border settlements and on-chain micropayments; Arc supports multiple stablecoins like USDC and EURC as gas tokens and deeply integrates Circle's own foreign exchange services, CCTP V2 cross-chain protocol, and Circle Gateway, making it more suitable for institutions requiring multi-currency, seamless cross-border liquidity.

In terms of compliance and transparency, Arc is backed by Circle's U.S. registration and IPO compliance background, with USDC reserves 100% supported by cash and U.S. Treasury bonds, audited monthly by the Big Four accounting firms, complying with multiple regulatory frameworks such as the EU's MiCA. This full transparency and high compliance is the "safety net" most favored by institutions, but it also means high costs and low profit margins; Stable, on the other hand, relies on Tether's market dominance, with more high-yield but high-risk assets in Tether's reserves, and less transparency in information disclosure compared to USDC, limiting its penetration in strictly regulated markets while maintaining higher profitability.

In terms of project progress and capital support, Stable has launched its testnet and completed a $28 million seed round led by Bitfinex and Hack VC; Arc has yet to enter the testnet phase, but USDC is backed by heavyweight institutions like Coinbase and BlackRock, providing resources and credit endorsement.

This L1 stablecoin public chain competition is not just a game for crypto-native companies. Recently, fintech giant Stripe has also been reported to be collaborating with crypto venture capital firm Paradigm to develop a payment-focused L1 blockchain called Tempo. This chain will be compatible with Ethereum programming languages and is positioned as an efficient, low-friction payment settlement network. Although Tempo is still in secret development with a team of only five, Stripe's accompanying actions demonstrate its ambition, including an $1.1 billion acquisition of stablecoin infrastructure company Bridge and the acquisition of crypto wallet developer Privy. This indicates that Stripe is building a full-stack crypto payment infrastructure from issuance, custody to settlement.

This trend of stablecoin-specific chains may see more participants. Previously, stablecoins primarily relied on public chains like Ethereum and Tron, lacking underlying networks tailored for payment, settlement, and compliance scenarios. Now, as stablecoins enter mainstream financial markets and take on larger-scale cross-border payment and financial settlement functions, more institutions developing their own chains will likely become a trend. However, building an L1 from scratch means facing multiple challenges such as technical security, ecosystem cold start, economic incentives, and regulatory compliance, with significant investment and concentrated risks. In contrast, building an L2 based on mature public chains, while slightly less autonomous, can inherit existing security and liquidity, quickly connect to developer and user ecosystems, and may become a more efficient and lower-risk compromise for some institutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。